Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Yes, gift cards are amazing because they are great gifts and make payments convenient. But did you know that you can also budget using gift cards? That’s another advantage gift cards have to offer their users.

Gift cards come in both physical and digital formats and any of them can be used to avoid overspending. Since gift vouchers come in different amounts, you can buy one that matches your budget or is closest to your budget amount. It’s like using cash envelopes but in an upgraded way.

If you would like to know more about how to budget with gift cards, keep reading. In this article, I’ll walk you through the steps involved in budgeting with gift vouchers and why it is a good idea. Without further ado, let’s get started.

Now that you know that you can use gift cards as a budgeting tool, how do you go about it? It’s simple. Budgeting with cards basically involves designating the funds of a particular gift card to a particular expense. That way when the funds are exhausted, you won’t be tempted to overspend.

Here’s how you can go about using gift cards to budget step by step:

Still a little confused? Let me explain each point one after the other.

First, you need to create a budget. List all your income sources and expenses. Include everything from rent and groceries to entertainment and savings. This will give you a clear picture of where your money is going. Use simple tools like a notebook or a budget app to keep track.

Also, think about your goals. Do you want to save more or spend less? This will help you allocate your resources wisely. A budget is not just about cutting costs; it’s about making your money work for you. When you see where your money goes, you can make better decisions.

Next, decide which expenses you want to use gift cards for. Common choices include groceries, entertainment, and dining out. Gift cards can help you control spending in these areas. Choose expenses that you regularly have and are easy to predict.

For example, if you spend $200 a month on groceries, buy a $200 grocery gift card. It could be from Target, Walmart or any supermarket you usually shop at. This way, you can’t overspend. Using gift cards for specific expenses makes sticking to your budget easier.

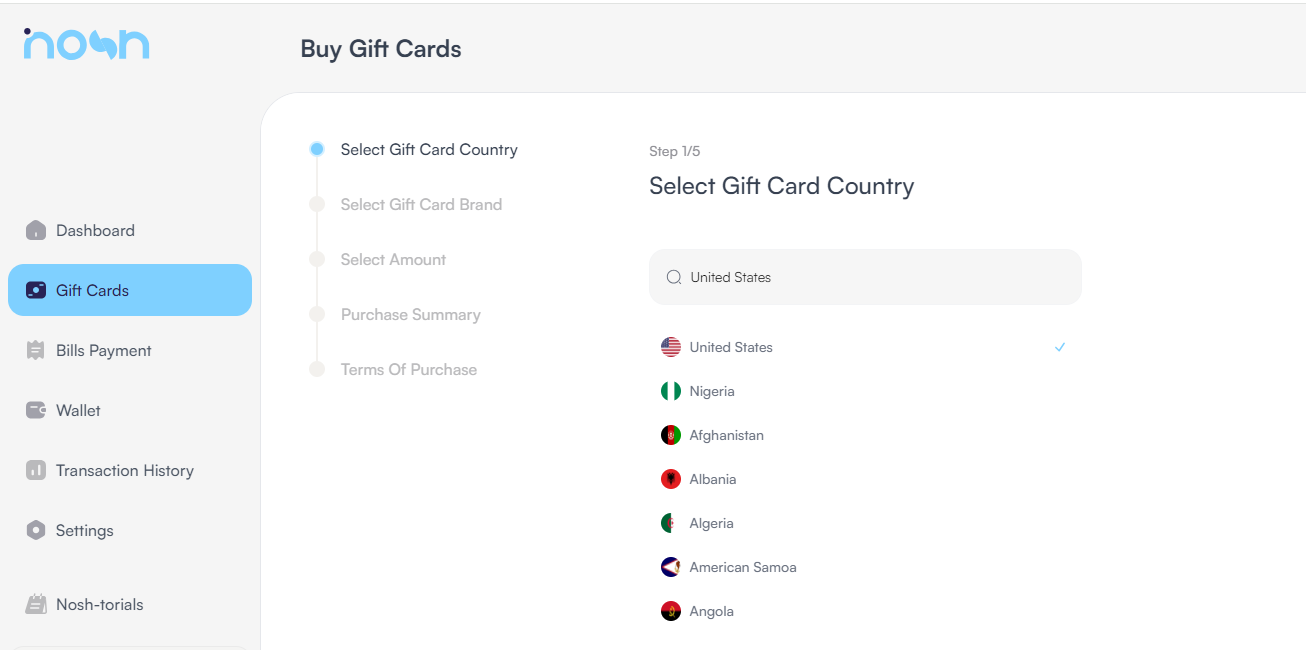

Once you’ve figured out what expenses you want to use gift cards for, buy the gift cards you need. Nosh offers a wide range of gift cards for many brands. You can buy gift cards for grocery stores, restaurants, and even clothing stores. Buying gift cards from Nosh is fast, convenient, and cheap.

Try to buy gift cards only for places you shop at regularly. This way, you know the card will be used and your funds won’t go to waste. Additionally, get the gift cards in denominations exactly or close to your budget.

After buying your gift cards, keep track of the balances. You don’t want to run out of money unexpectedly. Use a notebook, an app, or even a simple spreadsheet. Write down the starting balance and subtract each purchase.

For example, if you have a $100 Target gift card and spend $30, write down that you have $70 left. Also, check your gift card balance to confirm it. Regularly checking your balances helps you stay on top of your spending. It also prevents you from accidentally overspending.

Lastly, make adjustments as needed. Your budget is not set in stone. If you find that $200 for groceries is not enough, you might need to buy a gift card with more funds next month. Or, if you’re not using your dining-out gift card as much, you can adjust that too.

Life changes, and so should your budget. You could get a raise or your expenses could change. Keep an eye on your spending and make tweaks to your budget and gift card purchases. Adjusting helps you stay flexible and ensures your budget works for you, not the other way around.

Using gift cards to budget is a smart and easy way to control your spending. It turns your budget into something tangible and helps you stick to it. Here are some reasons why using gift cards can be helpful for managing your money.

1. What is a budget?

A budget is a spending plan that shows the estimate of the money you make and the expenses you plan to spend it on. It helps you have an overview of your income and expenses as well as determine how you allocate your resources.

2. How do I budget using a gift card?

To budget with a gift card, choose expenses you want to use the gift card for like groceries or dining out. Buy gift cards for those amounts and use them instead of cash or a credit card. Also, track the balance to ensure you stay within your budget.

2. What are the pros of using gift cards to budget?

Gift cards help you control spending, simplify tracking, allocate funds to specific categories, and can help you enjoy discounts or promotions.

3. What are the cons of budgeting with gift cards?

Gift cards can be restrictive, limiting where and how you spend. If you lose the card, you lose the money. Also, they may have expiration dates or fees.

Using gift cards to budget is a practical and effective way to manage your money. Follow the steps in this article and let that guide you through budgeting.

Gift cards can help you stay on top of your finances by setting clear spending limits, making budgeting more enjoyable, and simplifying expense tracking. Plus, they offer great benefits like discounts and deals, making them even more valuable.

Do you want to buy gift cards to budget with or sell unused ones? Download the Nosh app now for fast transactions and instant payouts.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.