Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers from fraud, identity theft, and unauthorized access. Without your BVN, you can’t perform many banking activities like applying for loans or using digital banking services.

Luckily, checking your BVN online is quick and easy. Whether you’ve forgotten it or just want to confirm it, there are safe and convenient ways to retrieve your BVN without visiting a bank branch. In this guide, I’ll show you the different methods you can use to check your BVN online or with your mobile phone.

Your Bank Verification Number (BVN) is essential for accessing banking services in Nigeria. These include registering for a loan, setting up mobile banking, and recovering an account. Here are five trusted BVN lookup methods to retrieve it securely.

One of the fastest ways to access your BVN is through the mobile number linked to your BVN at registration. You can use this method with MTN, GLO, 9mobile, or Airtel.

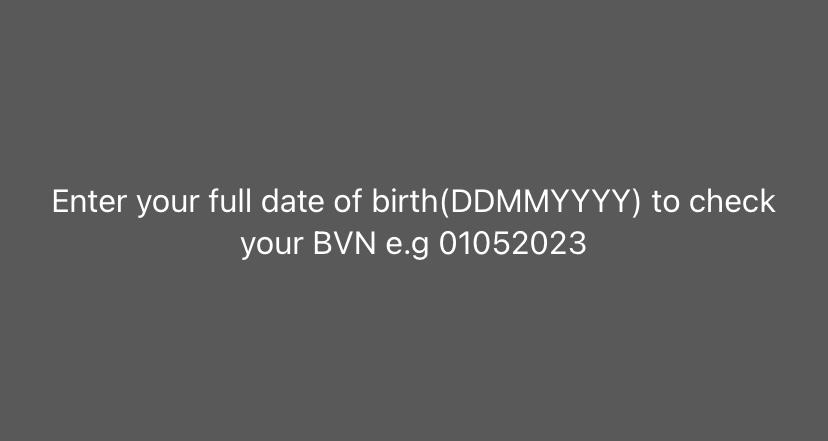

Steps:

Copy it down for future use or save it in a secure place. Note that this method will cost N20 from your airtime balance.

When you registered for your BVN, the bank gave you an enrollment slip with your unique BVN number printed on it. If you still have this slip:

This is a reliable offline method when you can’t use a mobile phone or internet connection. However, it only depends on whether you kept the slip after registration

Most Nigerian banks have made it easy to check your BVN directly in their mobile banking apps. Here’s how:

Steps:

This method is secure, especially if you already use mobile banking. Be sure your app is updated to the latest version.

If you’ve lost access to your mobile line or can’t retrieve your BVN online, you can always visit your bank branch. After confirming your identity, the bank’s customer service team can help retrieve your BVN.

What to bring:

Your National Identification NumbeR (NIN) can help retrieve your BVN. Visit the NIMC office nearest to you and provide your details.

It is important for you to have your BVN as this security number has different uses. They include:

If you don’t have a BVN yet, you’ll need to register at any Nigerian bank. The process is straightforward and usually takes less than 10 minutes, though activation may take up to 24-48 hours.

Anyone with a Nigerian bank account is required to register for a Bank Verification Number. This includes:

To register, you’ll need the following documents:

Your BVN becomes active within 24-48 hours and can be linked to all your bank accounts across different banks.

BVN issues are common, especially if you’ve changed your phone number or opened multiple bank accounts. Below are some frequent problems and how to solve them:

If you’ve lost the phone number linked to your BVN, you won’t be able to use USSD codes (like *565*0#) to retrieve it.

What to do:

Sometimes, dialing *565*0# returns an error or doesn’t work.

Possible reasons:

Solutions:

If you’ve forgotten your 11-digit BVN and can’t access your registered SIM card:

Options:

Tip: Once recovered, store it safely in a password manager or secure notes app.

The Central Bank of Nigeria mandates only one BVN per individual. If you’ve mistakenly registered more than once (maybe at different banks), this could cause issues like blocked accounts or transaction errors.

What to do:

The Bank Verification Number (BVN) is used to verify your identity across all Nigerian banks. It protects you from fraud, identity theft, and unauthorized access. It’s required for loans, mobile banking, account linking, and more.

A BVN number is 11 digits long. It’s unique to each person and remains the same even if you open new accounts with other banks.

No, the USSD method (*565*0#) requires the phone number linked to your BVN. If you no longer have access to that number, visit your bank to update it or retrieve your BVN in person.

No, BVN registration cannot be done online. You must visit a physical bank branch (or approved diaspora center) for biometric data capture. However, you can do a BVN check online if you already have your number.

No. You are legally allowed to have only one BVN. If you mistakenly registered for multiple BVNs, visit your bank to resolve the issue. The records will be merged by NIBSS.

No, your BVN does not expire. It is valid for life and can be used across all Nigerian banks

Yes. That’s the main purpose of BVN. Once registered, you can link the same BVN to all your bank accounts, no matter how many banks you use.

Yes. Nigerians living abroad can register at approved international centers or Nigerian embassies offering diaspora BVN enrollment. Contact your bank for more details or visit the NIBSS diaspora BVN page.

If you’ve ever struggled to access your BVN or didn’t know where to find it, now you have multiple safe options. The quickest method for most people is dialing *565*0# on the phone number linked to their bank account. If that doesn’t work, your bank’s mobile app or a visit to the branch will do the trick.

For those who lost their registered number or have BVN issues like multiple registrations, your best move is to speak with your bank directly.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.