Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at a staggering 23.18%. So, for every 100 naira you have today, you’re losing 23 naira over the next year. This means what you can buy now will cost you even more tomorrow.

The solution? Saving in dollars.

By saving in dollars, you can protect your money from the impact of inflation. The dollar is a global currency known for its stability, making it a reliable way to preserve the value of your hard-earned money. By saving in dollars, you shield your savings from inflation and devaluation while opening doors to international opportunities.

In this guide, I’ll explain how to save dollars in Nigeria, from using domiciliary accounts to fintech apps. I’ll also share the best apps for dollar savings and highlight why saving in dollars is a game-changing strategy for securing your financial future.

If you earn in dollars, it’s easier to save in dollars as it is more direct. On the other hand, if you don’t, you can use Naira to buy dollars to save. Additionally, you can’t spend dollars on day-to-day transactions since USD is not Nigeria’s official currency. To be able to spend your dollar savings, you have to convert it to Naira officially or through the black market.

There are two legal ways to save dollars in Nigeria. They are:

A domiciliary account is a specialized bank account that allows you to save, receive deposits, and transact in foreign currencies like dollars, pounds, or euros. It’s one of the oldest and most reliable ways to save dollars in Nigeria.

To open a domiciliary account, you must visit a bank offering this service. Most major banks in Nigeria, like GTBank, First Bank, Zenith Bank, and many more, allow you to open a domiciliary account. You’ll need documents such as a valid ID, proof of address, passport photographs, and a minimum deposit amount, which varies by bank. You can fund the account by depositing dollars directly or converting Naira to dollars using black-market exchange rates or through a bank.

In addition, you can use your domiciliary account for international transactions, such as paying tuition fees or shopping online. It’s a stable and secure saving option that gives control over your funds, as you can withdraw or transfer anytime. The drawbacks of using a domiciliary account include the high transaction fees and lengthy paperwork.

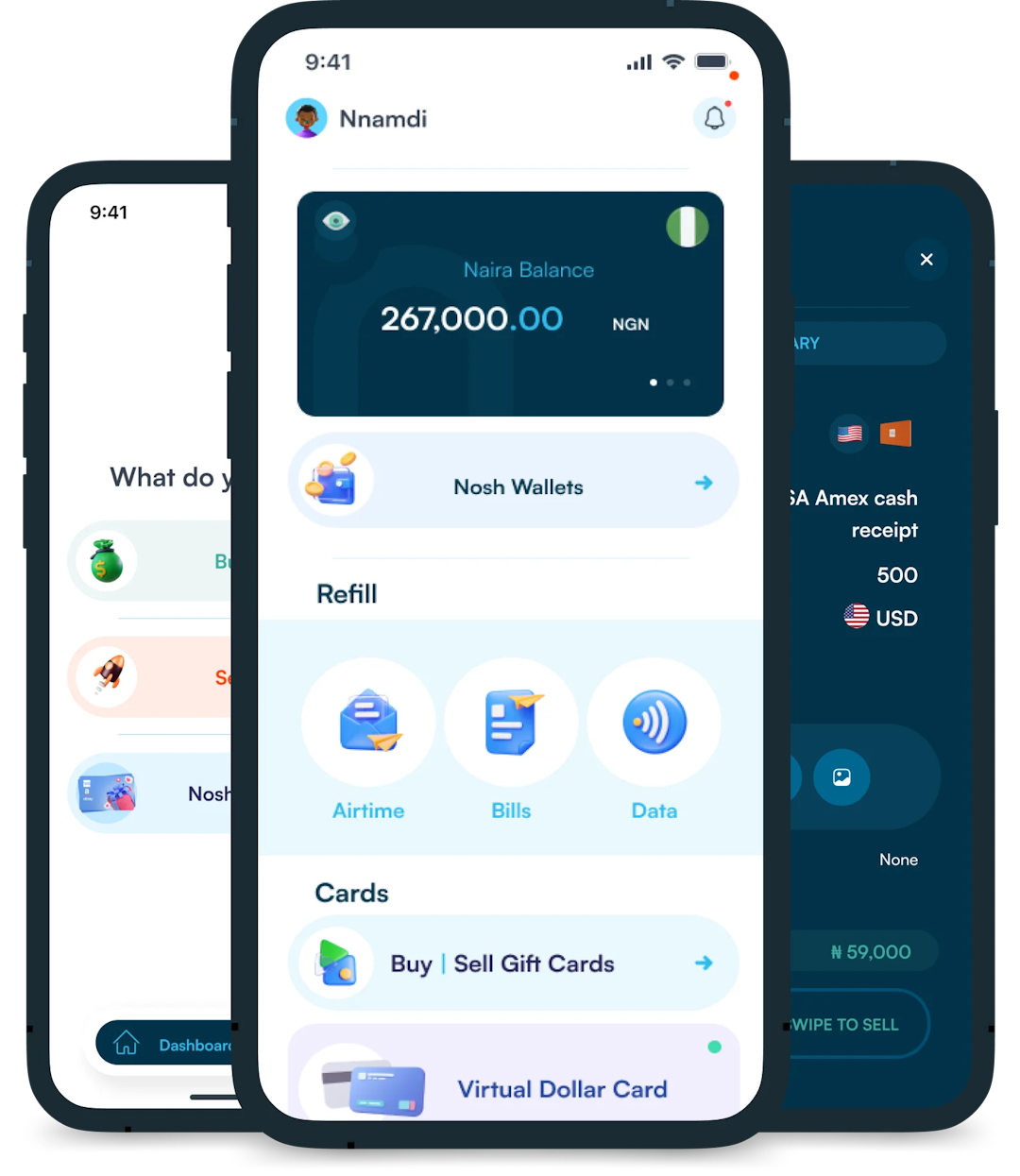

Fintech apps have made saving in dollars in Nigeria easier, faster, and more accessible. With these apps, you can convert your Naira to dollars at competitive rates and save them digitally without needing a domiciliary account.

Do your research before picking the one that works best for you. Then, sign up for any of these apps by adding your phone number, email address, and KYC details. Next, fund your wallet (which is your virtual account) by transferring Naira from your bank account to the app. Choose the option to save in dollars, and the app will automatically convert your Naira to dollars at the prevailing exchange rate.

However, if it is a cryptocurrency app, you can buy USDT or USDC with Naira.

Fintech apps are easy to use, eliminating the paperwork and lengthy process of opening a domiciliary account. Additionally, their transaction fees are lower compared to traditional banks. Plus, you can automate and track your savings.

The drawback is that the exchange rates may not always be favourable.

With the rise of fintech platforms, it has become more accessible than ever to save in dollars in Nigeria. These apps offer competitive exchange rates, secure platforms, and additional features like interest-earning savings plans.

Let’s explore the best fintech apps for saving in dollars in Nigeria. They are:

Let’s talk about these fintech apps one after the other.

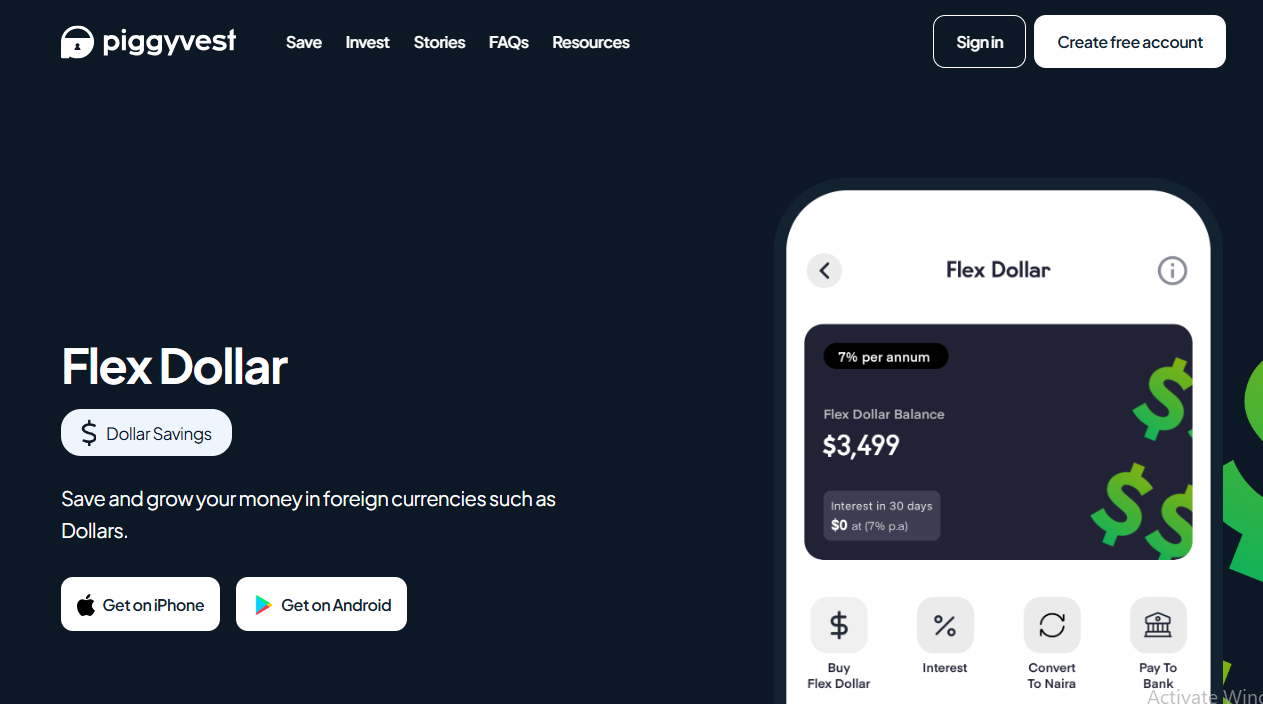

Piggyvest is a popular savings app in Nigeria, and it’s known for its user-friendly features and transparency. Its “Flex Dollar” feature allows you to save in dollars and earn up to 7% interest annually. The app makes it easy to convert your Naira to dollars directly within the platform. You can also automate your savings by setting up daily, weekly, or monthly contributions.

One major advantage of Piggyvest is its high security standards, which give users peace of mind about their funds. However, the app’s exchange rates might not be as competitive as those in the black market, and locking funds in fixed savings plans may restrict withdrawals during emergencies.

Bybit is primarily a cryptocurrency exchange, but it offers a convenient way to save in dollars using stablecoins like USDT (Tether), which is pegged to the US dollar. Users can buy USDT with Naira and hold it in their Bybit wallet as a dollar savings alternative.

What sets Bybit apart is its low transaction fees and the ability to earn interest through flexible savings or staking programs. These can provide annual returns depending on crypto market conditions. While it’s an excellent option for those comfortable with digital currencies, beginners may need time to get used to the app’s features.

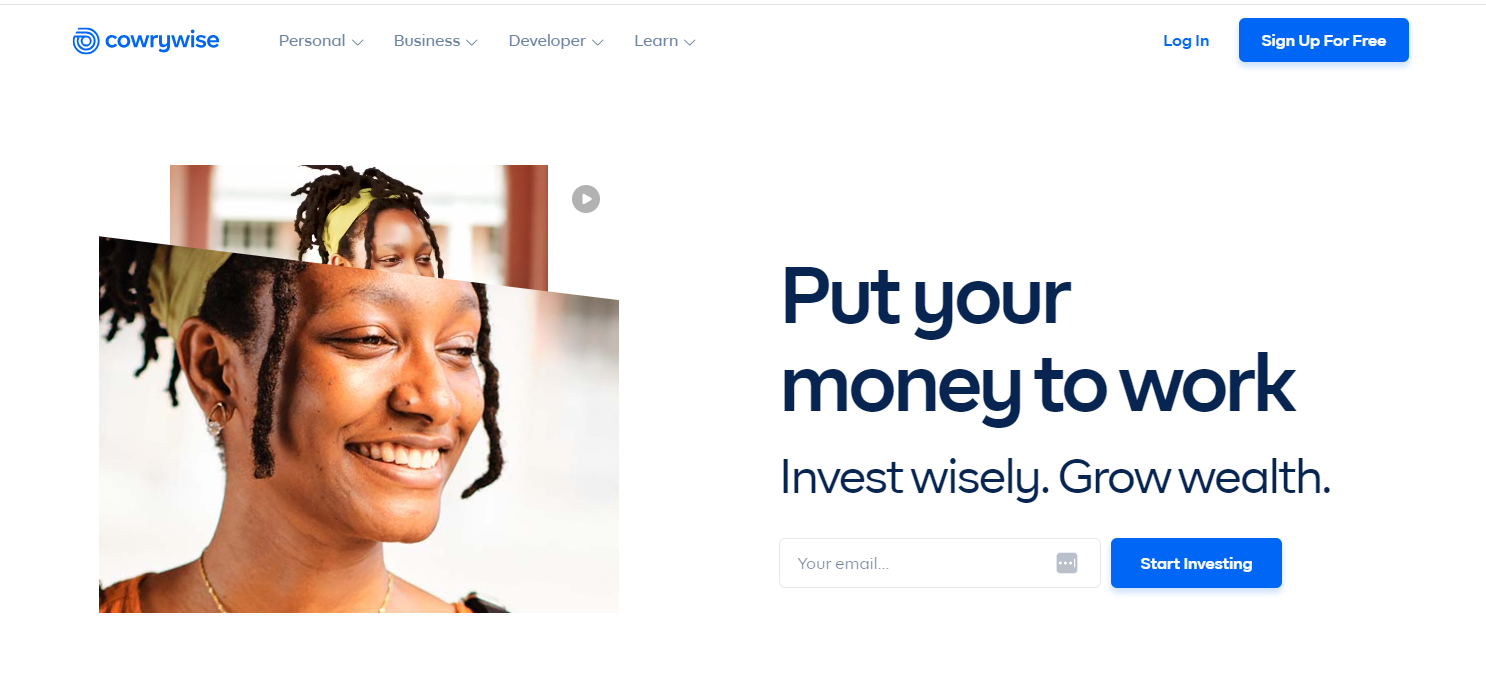

Cowrywise is another popular choice for saving in dollars. With the app, you can convert naira to dollars and save towards a particular goal. It offers flexible and fixed savings plans, enabling you to earn competitive interest rates on your dollar savings.

Cowrywise is regulated by the Securities and Exchange Commission (SEC), ensuring the safety of your funds. However, while it offers excellent customer service and helpful features, its interest rates for savings are not fixed.

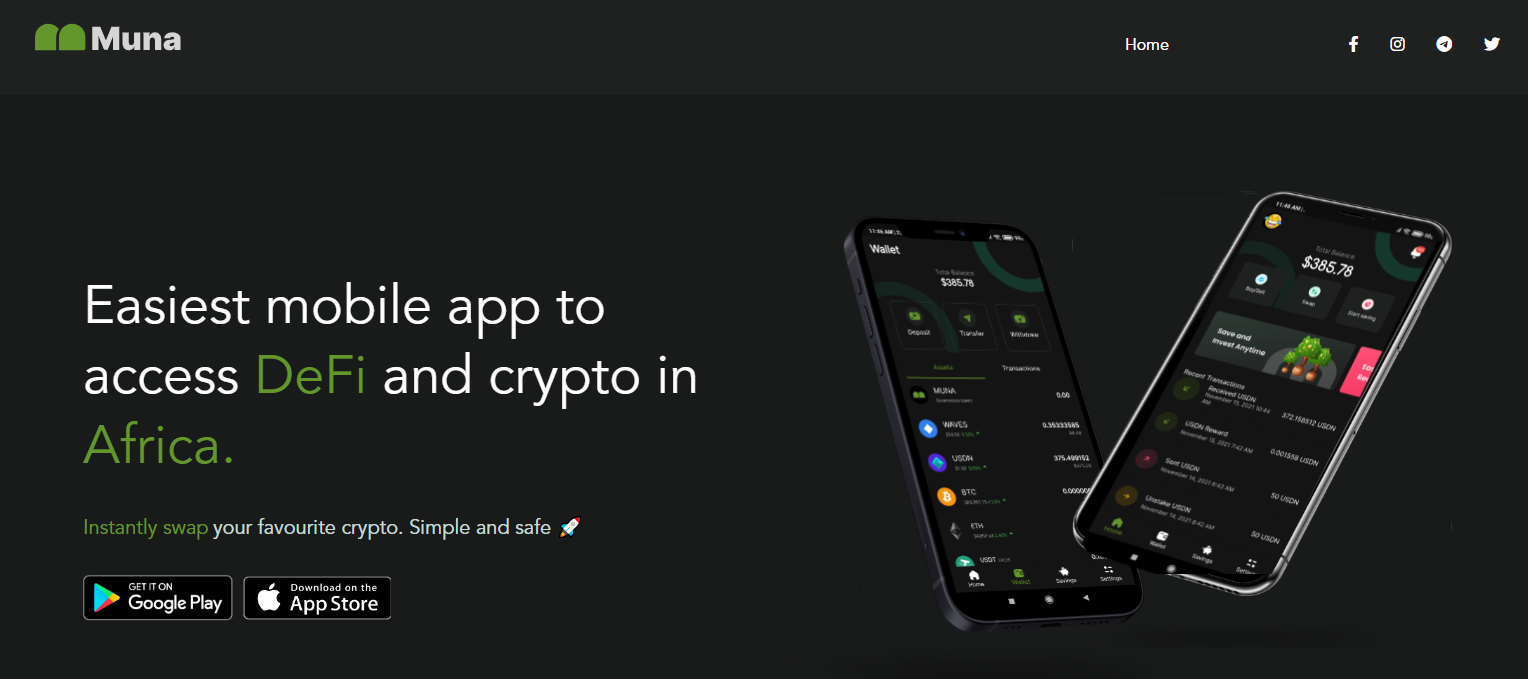

Muna is a specialized app designed to give Africans access to decentralized finance (DeFi) and cryptocurrency. With Muna, users can save in dollars through cryptos like USDT and USDC while earning competitive interests of up to 7% annual percentage yield (APY).

Additionally, you can buy, sell, swap, and send cryptocurrency on the Muna app. It’s particularly useful for those who frequently deal with crypto transactions, as it provides transparent fees and favourable exchange rates. However, Muna’s limited range of features might be a downside for users unfamiliar with crypto.

There are many reasons why saving in dollars is a good idea, four of which are:

It depends on where you save. With a bank, you may need to give prior notice before making a withdrawal, as cash availability isn’t always guaranteed. Fintech apps allow faster access to your naira account but come with fees.

2. How do I fund my domiciliary account?

The most common way is to deposit physical dollars at the bank. Another option is to receive international transfers from employers, clients, family, or friends abroad. Finally, for fintech, you can convert naira from your account to dollars, but the prevailing exchange rate applies.

3. Can I earn interest on my dollar savings?

Yes! Banks and fintech platforms offer interest on dollar savings accounts. Dollar fixed deposit options are also available, although the returns may not always be attractive.

4. Is it legal to save in dollars in Nigeria?

Yes, it is legal to save in dollars. It is important to note, though, the Central Bank of Nigeria (CBN) regulations on forex transactions. Policies can change, so it is best to stay updated on the latest government regulations regarding foreign currency savings.

5. How much do I need to start saving in dollars?

The amount you need to start saving in dollars varies depending on your chosen platform. Opening a domiciliary account at a bank might require a minimum deposit (like $100 and above). Some fintech platforms, like Piggvest, allow you to start saving with as little as $1.

Saving in dollars is a practical and effective way to protect your money from Nigeria’s economic challenges. It’s a smart financial move to guard against inflation and currency devaluation. You can open a domiciliary account with any traditional Nigerian bank or use a fintech app to save dollars in Nigeria.

Choose the option that best suits your needs and take control of your financial future today.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.