Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever found yourself Googling things like ‘cheapest way to send money to Nigeria’ because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve been there too. As someone who sends money back home to support family and friends, I know how frustrating it is when your hard-earned money takes days to arrive, or worse, disappears into thin air with zero customer support.

That’s why I put this list together. In this article, I’ll introduce you to the top 10 best apps to send money to Nigeria, highlighting their features, benefits, and how they make sending money quick and easy.

Whether you’re a Nigerian student abroad, a parent sending support, or just someone trying to help out a loved one, these are the 10 best and most reliable apps that make transferring money from abroad to Nigeria fast, secure, and affordable.

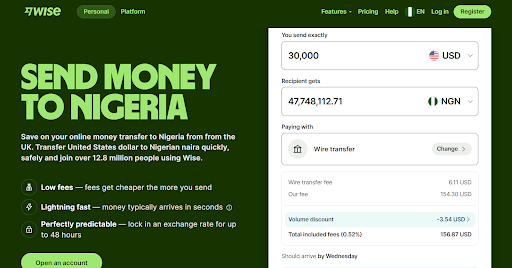

Wise is one of the cheapest and safest ways to send money to Nigeria. This transfer service uses the mid-market exchange rate -the same one you’d find on Google, meaning you get more value for your money. Transfers to Nigeria are typically completed on the same working day, making it a top choice if you’re seeking cheap ways to send money to Nigeria.

On Wise, there is no minimum transfer amount, and the maximum transfer limit is 120,000 GBP (or NGN equivalent) per month. But keep in mind that your exact transfer limit may vary depending on the country you reside in and how much verification you’ve completed.

Unique Features:

Fees:

These fees are clearly displayed before you confirm the transfer:

Security:

Wise employs two-factor authentication (2FA) and high-tech encryption protocols to protect user data and transactions. The app is also regulated by financial authorities across multiple countries.

How to Use Wise:

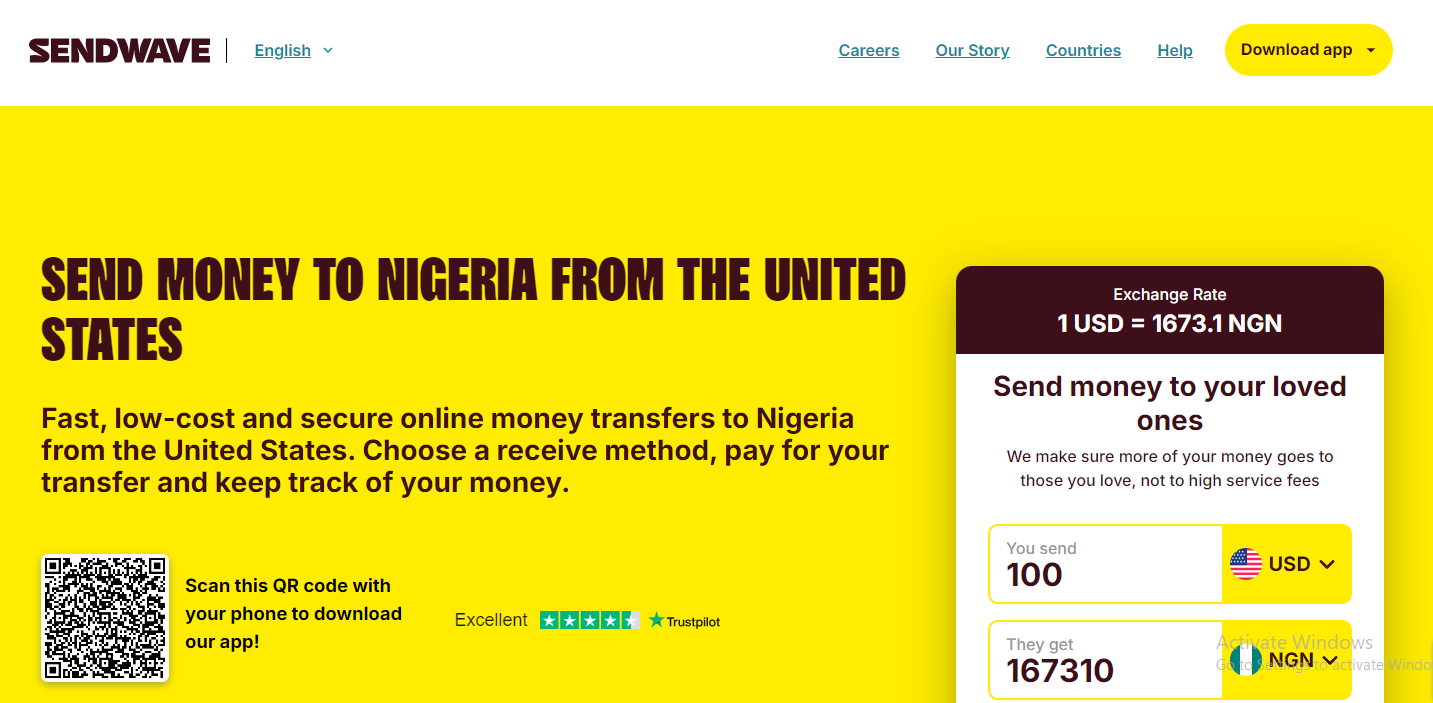

Sendwave is a service designed for affordable money transfers from select countries in North America and Europe to Nigeria. Currently, Sendwave supports cash pickup and transfers to three Nigerian banks -Access, Zenith, and Fidelity Bank. And the best part? You get to enjoy zero transfer fees.

When making international payments to Nigeria on Sendwave, there are limits to how much you send per day and per month. To know your sending limits, go to Menu on the app and tap on My Limits. These limits increase automatically the more transactions you make.

Unique Features:

Security:

Sendwave employs 256-bit encryption to protect your data during transactions. Additionally, Sendwave is licensed in every country it operates.

How to Use Sendwave:

Remitly offers cash pickups, mobile money, and bank deposits to the most popular banks in Nigeria, which include First Bank, Access Bank, Ecobank, United Bank For Africa (UBA), First City Monument Bank (FCMB), and Union Bank.

It offers two primary options for transfers: Economy and Express. The Economy option allows you to send money at a lower cost, but transfers take longer, while Express transfers are near-instant but come with slightly higher fees.

Perhaps the most exciting part of using Remitly is their new customer offer that gives you a higher exchange rate on your first money transfer. This promotional rate is valid on the first 500.00 USD sent. Also, when you’re sending from USD to NGN, you get to enjoy zero fees on all transfers.

Unique Features:

Transfer Limits

There are limits on how much you can send in 24 hours, 30 days, and 120 days, depending on your location, recipient’s location, and identity verification.

Security:

Remitly employs industry-standard security measures, including encryption and fraud detection systems. The app also supports biometric logins for secure and convenient access.

How to Use Remitly:

WorldRemit is a globally recognized platform that allows you to send money from over 50 countries directly to Nigerian bank accounts, mobile wallets, or for cash pickup. As of 2025, the following Nigerian banks can receive transfers from WorldRemit: Access Bank, Ecobank, FCMB, Fidelity, First Bank, GT Bank, UBA, Union Bank, and Zenith Bank.

There are transfer limits on WorldRemit, depending on the sender’s country,the recipient’s country, and payment method. Transfers to Nigeria are typically completed within minutes, and you can enjoy fee-free transfers when sending in Naira.

Unique Features:

Security:

WorldRemit employs tight security measures, including two-factor authentication and encryption protocols. The platform is also regulated by financial authorities in multiple countries.

How to Use WorldRemit:

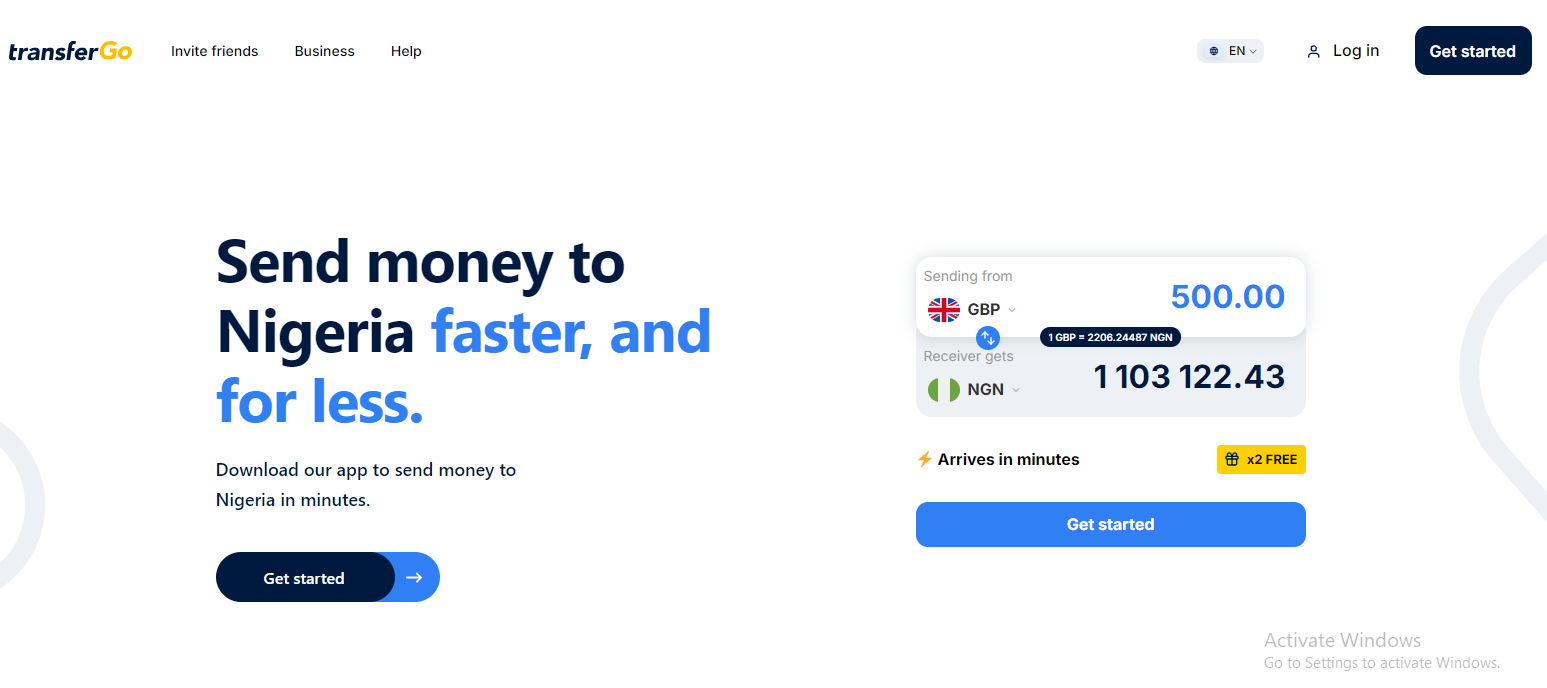

With TransferGo, you can send money to Nigerian bank accounts for free and within minutes. Transfers are usually made locally, from TransferGo’s Nigerian account to your recipient’s Nigerian account, thereby avoiding expensive international transfer fees.

TransferGo allows different kinds of transfers to Nigeria -instant card transfers, bank transfers, and next day transfers. The platform allows you to choose between faster delivery or lower fees, and with the fastest option, your recipient in Nigeria can receive funds in under 30 minutes.

Unique Features:

Security:

TransferGo is FCA approved and regulated by EU and UK law. The app makes use of employs end-to-end encryption and fraud detection systems to protect your money and data.

How to Use TransferGo:

Western Union is one of the oldest and most trusted names in international money transfers. With its app, you can send money to Nigeria from over 200 countries, and your recipient can either receive the money in their bank account or pick it up in cash at a Western Union agent location.

The app supports transfers to major Nigerian banks like First Bank, GTBank, and Access Bank. Western Union also provides real-time transfer tracking and notifies you of any changes in fees or exchange rates. Transfer fees vary based on the sending country, payment method, and delivery option. But don’t worry, the platform offers competitive exchange rates, and you can use their price estimator tool to calculate the total cost of your transfer. Transfers to Nigeria are typically completed within minutes, especially when using the cash pickup option.

Unique Features:

Security:

Western Union employs high-grade security measures, including encryption, fraud detection systems, and real-time tracking of transfers

How to Use Western Union:

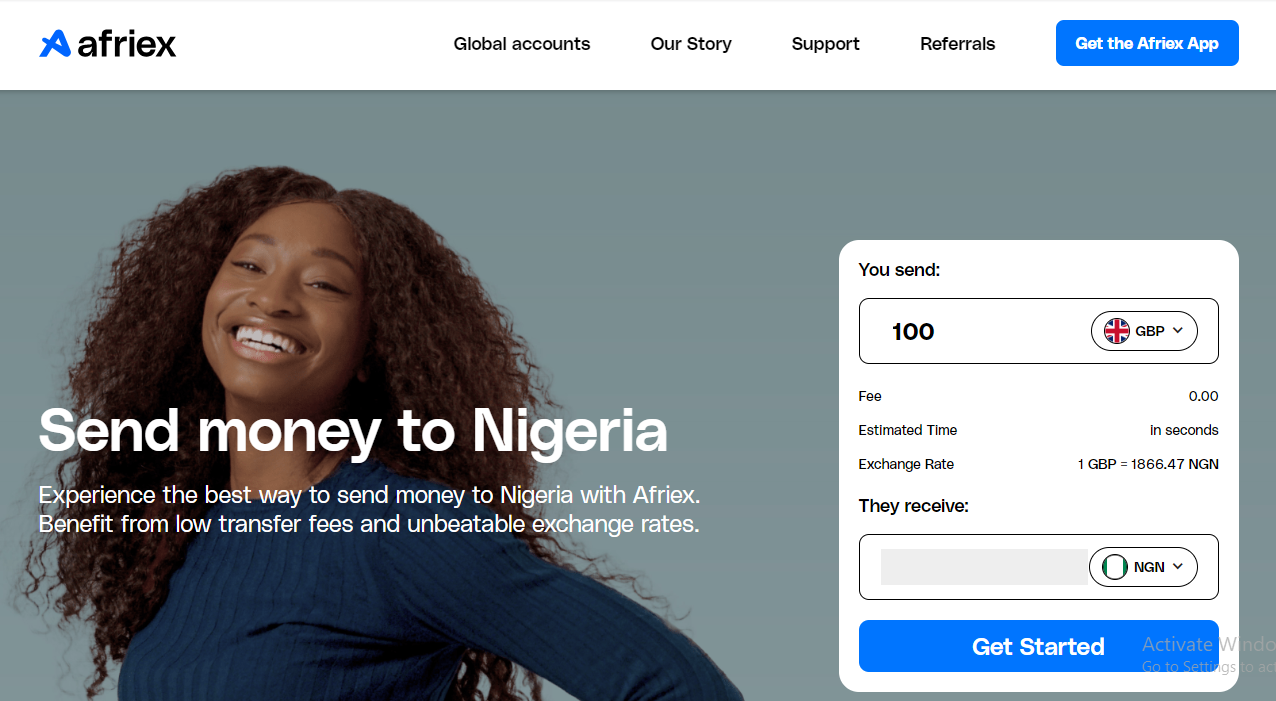

Afriex is a modern money transfer app that offers fast and affordable transfers to Nigeria. It offers zero transfer fees and competitive exchange rates, ensuring your recipient receives more in their local currency.

With this app, you can send up to $3000 (or NGN equivalent) daily to Nigeria. To increase your transfer limits, additional verification may be required. Additional documentation may be required for higher amounts. My favorite part of this app is that it supports sending and receiving in cryptocurrencies.

Unique Features:

Security:

Afriex is ISO 27001 certified and PCI DSS compliant. They use industry-standard encryption technology and two-factor authentication to protect user data.

How to Use Afriex:

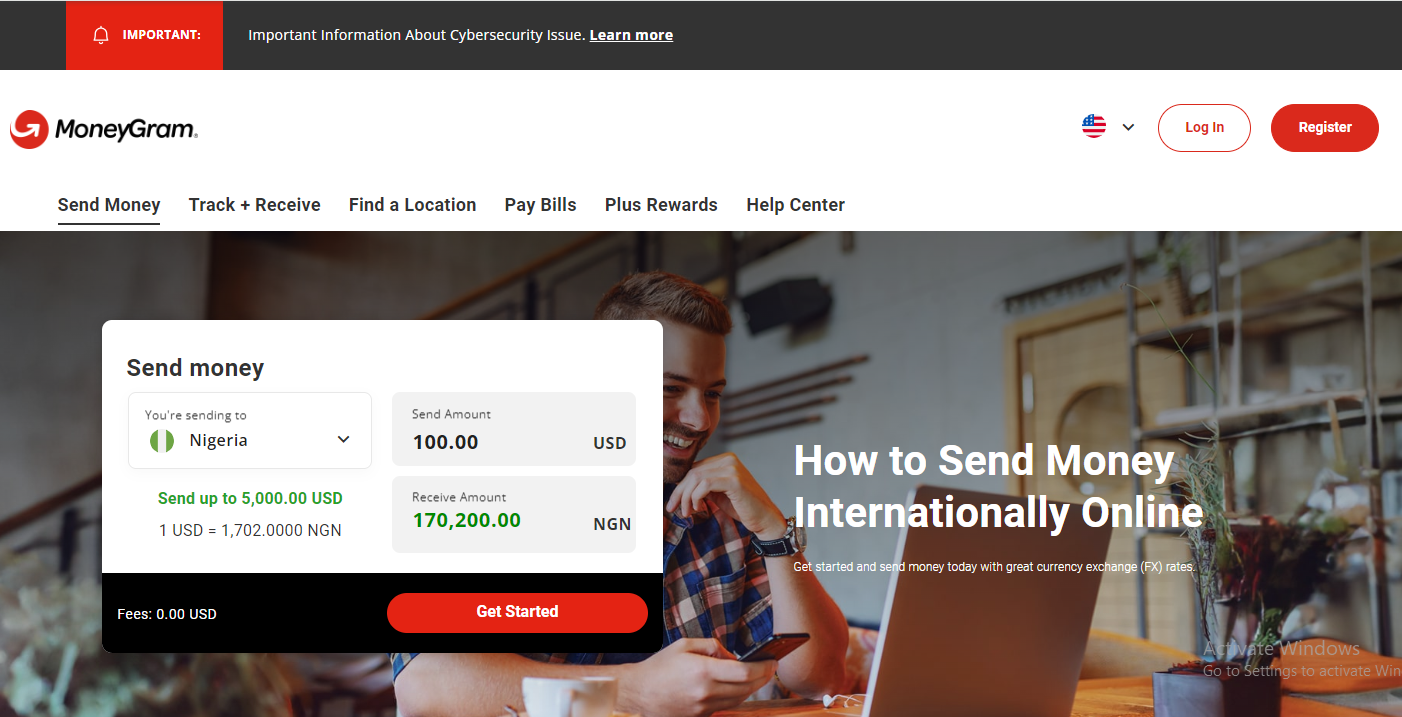

MoneyGram is a well-established money transfer service that allows you to send money directly to Nigerian bank accounts or arrange for cash pickup at various locations across Nigeria. The app is user-friendly, and it supports international transfers in more than 200 countries.

The fees for sending money vary depending on your location and the transfer method, but the first transfer is often free. Additionally, MoneyGram offers competitive exchange rates, making it a solid choice for sending money to Nigeria. MoneyGram currently partners with more than 20 Nigerian banks, including Access Bank, First Bank, GTBank, UBA, and FCMB.

Unique Features:

Security:

MoneyGram monitors transactions for suspicious activity to prevent fraud. They also provide resources to educate users about common scams and how to avoid them.

How to Use MoneyGram:

Revolut is a financial app that offers international money transfers at competitive rates. With Revolut, you can send money to Nigerian bank accounts quickly and at low fees. The app is available in over 30 countries and supports multiple currencies, including NGN.

Revolut’s competitive exchange rates and fast processing times make it an attractive option for users who need to send money regularly. In addition to money transfers, Revolut offers a suite of banking features like budgeting tools, cryptocurrency trading, and virtual cards, giving users a comprehensive digital banking experience.

Unique Features:

Security:

Revolut uses two-factor authentication to prevent fraudulent activities. Also, access to the app requires fingerprint or facial recognition.

How to Use Revolut:

With the Grey app, you can send money directly to Nigeria in multiple currencies. This transfer service is particularly beneficial for Nigerian freelancers and remote workers receiving payment from international clients. Grey supports transfers to all major Nigerian banks, including Access Bank, First Bank, GTBank, UBA, Zenith Bank, and others.

The app is user-friendly and supports currency conversions, allowing you to switch between currencies like USD, EUR, GBP, and NGN easily. Grey has low fees, and if you are sending money from one Grey account to another Grey account (using the GreyTag), the transaction is free.

Unique Features:

Security:

Grey employs two-factor authentication (2FA) and encryption to safeguard user data and transactions. Additionally, the platform is regulated by FinCEN in the U.S. and FINTRAC in Canada, ensuring compliance with international financial standards.

How to Use Grey:

You can use apps like Wise, Remitly, WorldRemit, MoneyGram, and Western Union to transfer money directly to Nigerian bank accounts. These apps support major Nigerian banks, including GTBank, Zenith Bank, UBA, and Access Bank, making it easy to send money securely and quickly.

2. What is the easiest way to send money to Nigeria?

The easiest way to send money to Nigeria is through international remit mobile apps like Sendwave, WorldRemit, Revolut, etc. These apps let you send money directly to a Nigerian bank account or for cash pickup. The process is straightforward, and transfers are often completed in minutes.

3. What is the best app to send money to Nigeria?

The best app for you depends on your needs. For low fees and speed, Sendwave is great. If you want more options like bank deposits, cash pickup, and mobile wallets, apps like Western Union or WorldRemit might be better. Both offer competitive exchange rates and work with major Nigerian banks.

4. Is it safe to use money transfer apps?

Yes, it’s safe to use money transfer apps. These apps use encryption to protect your data and have multiple security features to ensure your money gets to the right place. Always use trusted apps and avoid sharing your details with third parties.

5. Which apps for sending money to Nigeria are free to use?

Afriex and Sendwave are two apps that allow you to send money to Nigeria without charging any transfer fees. They offer competitive exchange rates and fast transfers, making them cost-effective options.

Sending money from abroad to Nigeria doesn’t have to be stressful or expensive. Each app has unique benefits, such as zero fees, fast transfers, or additional features like cryptocurrency options. I believe, regardless of your needs, there’s an app here that fits your needs.

Personally, I switch between Wise and Sendwave depending on what I’m trying to do, but your choice depends on how much you’re sending, how fast it needs to get there, and what the recipient prefers.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.