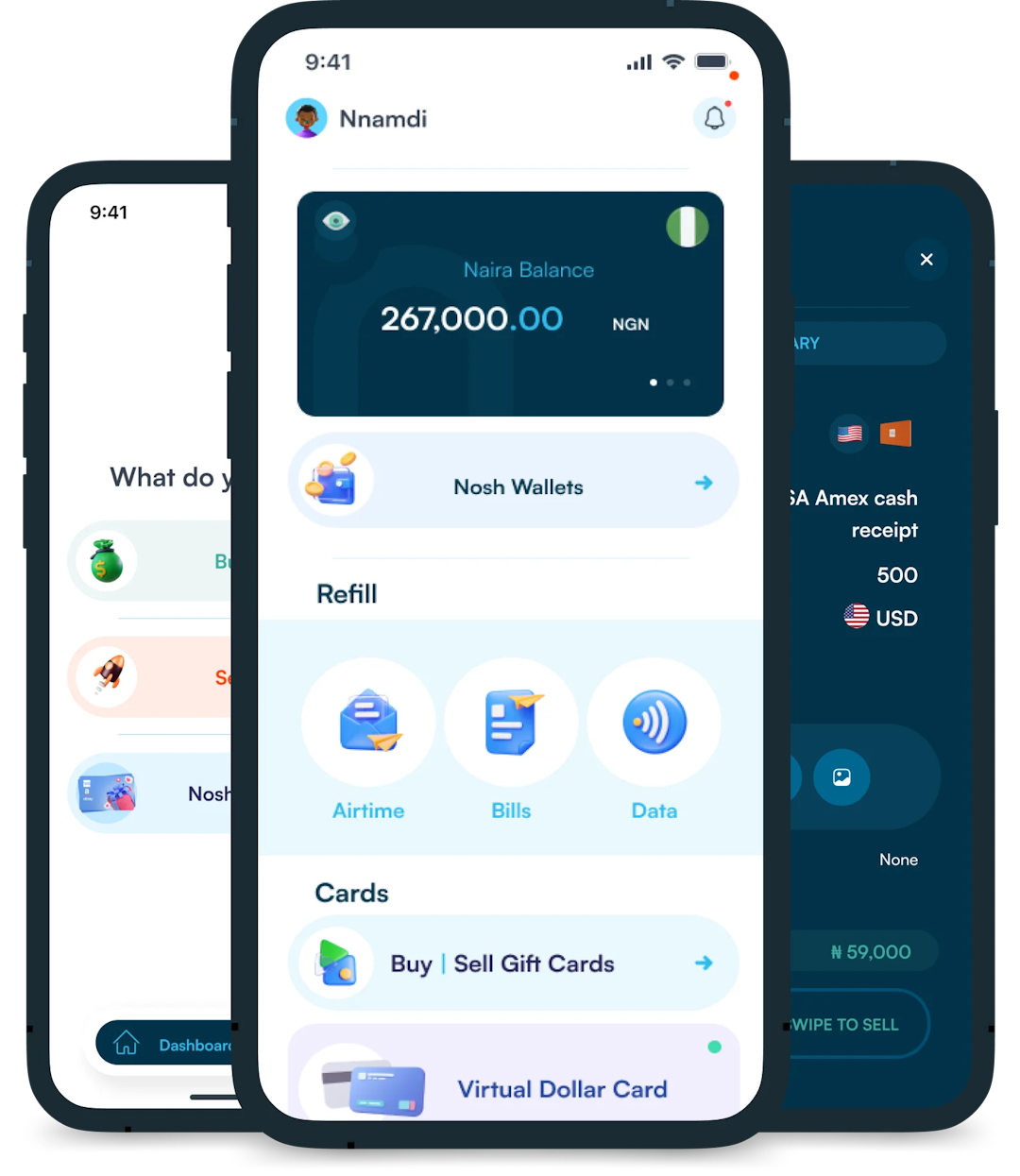

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Think of a parent with a kid studying abroad or a father who works overseas and has to send money to his family back home. Imagine how stressful it would be if all the parties involved had to visit the bank to send or receive money. Well, this was the case before international money transfer apps.

Today, sending money across borders has never been easier, thanks to various digital payment solutions, including International money transfer apps, that offer speed, security, and affordability. With just your phone and internet connection, you can transfer money to anyone, anywhere.

Whether you’re supporting family overseas, paying for services, or handling business transactions, choosing the right money transfer app is crucial.

In this article, I’ve reviewed five (5) of the best international money transfer apps for 2025, giving insights about their features and pros and cons to help you make an informed choice. Let’s get started!

International money transfer apps are applications you can use on your phone or computer to send money to someone in another country. These apps have digital wallets where you can store funds or link them to your bank account or credit/debit card, allowing you to send money across borders without visiting a bank.

For example, if you’re working in the U.S. and want to send money to your family in Nigeria, an app like Remitly can do that for you. These apps convert currencies and make sure the money reaches the recipient securely. With these apps, you save time, pay lower fees, and can send money from the comfort of your home.

Some apps even have extra features like tracking your transfers, setting reminders for regular payments, etc.

Whether you want to send money for your child’s school fees abroad or help out family members back home, global money transfer apps let you skip long bank queues and high charges. While there are several choices, I have reviewed the different types of money transfer apps available today and compiled a carefully selected list.

Below are my top picks of international money transfer apps you can use in 2025:

Let’s now explore each app.

Wise, formerly known as TransferWise, is popular for its low-cost international money transfers. The app is known for its transparency and real-time exchange rates with no hidden fees. With Wise, you can send money to over 70 countries. In addition to sending and receiving money internationally, you can always use Wise to manage your bills.

How It Works

Wise lets you send money directly from your bank account or card. When you send a particular amount across the border, Wise converts it using its current exchange rate, and the recipient receives the money in their local currency after confirming the transaction.

Key Features:

Pros:

✔️ Transparent fees with no hidden charges.

✔️ Fast and secure for transfers compared to traditional banks.

✔️ Easy-to-use app with a user-friendly interface.

Cons:

❌ Limited payment options; no instant cash pickup option.

❌ Some bank transfers can take 1-2 days

❌ Transaction limits that vary depending on the currency.

Visit Wise for more details.

WorldRemit is a global money transfer service that offers numerous transfer options, including bank deposits, mobile wallets, and cash pickup. It is a reliable choice for sending money to different countries, supporting transfers to over 130 countries.

How It Works

WorldRemit allows you to send money directly to a bank account or mobile wallet and for cash pickup at various locations across the recipient’s country. Its features enable you to choose how the recipient gets the money when setting up the transaction.

Key Features:

Pros:

✔️ Flexible delivery options (bank, mobile, cash pickup).

✔️ Fast and secure transfers.

✔️ Recipients without a bank account can receive alerts on their mobile money accounts.

Cons:

❌ Higher fees for instant transfers.

❌ Limited availability for certain countries.

❌ Slightly higher exchange rate compared to some competitors.

Visit WorldRemit for more information.

Revolut is a financial app that allows users to send and receive money internationally with low fees. It was formerly a banking app, but Revolut now provides international money transfers, which is especially popular in Europe and the U.S. Additionally, as a Revolut user, you can split bills, send gifts, and exchange currencies.

How It Works

Revolut lets you send money by connecting your bank account or credit card to the app. You can transfer funds to other Revolut users instantly and to non-users through bank transfers at low costs.

Key Features:

Pros:

✔️ Instant and fee-free transfers for Revolut users.

✔️ Easy currency exchange between accounts.

✔️ User-friendly app with spending analytics.

Cons:

❌ Limited availability outside Europe and the U.S.

❌ Fees apply after reaching your transfer limit.

Visit Revolut for more details.

Remitly is a well-known international money transfer service. The service provides affordable transfers with various delivery options. It is especially popular among migrants sending money to their families back home.

How It Works

You can send money through Remitly to a bank account or mobile wallet, or for cash pickup at a partner location. The app offers two speeds: Express, which delivers within minutes but has higher fees, and Economy, which takes a few days but costs less.

Key Features:

Pros:

✔️ Multiple delivery options (bank, mobile, cash pickup).

✔️ Express transfers available.

✔️ Affordable fees, especially for economy transfers.

Cons:

❌ Higher fees for instant transfers.

❌ Limited availability for certain countries.

Visit Remitly for more information.

Western Union is among the oldest and most trusted money transfer services globally. It allows you to send money to nearly every country, including Nigeria, with flexible options for receiving funds, such as cash pickup or bank transfer.

How It Works

Western Union lets you send money through their app, website, or in person at an agent location. You can send the money for cash pickup or deposit into a bank account.

Key Features:

Pros:

✔️ Wide global reach with agent locations in many countries.

✔️ A long history of trusted and reliable service.

✔️ Widely available cash pickup

Cons:

❌ Higher fees compared to digital-only services.

❌ Exchange rates include a less favorable markup.

Visit Western Union for details.

We have selected these apps as our top picks for international money transfers. Each offers unique features suited to your needs.

Sending money internationally through an app is simple, and most services follow a similar process.

When choosing the best international money transfer app, you must consider how fast you need the money to arrive. Some services deliver funds within minutes, while others may take a few days.

Security is another key factor. A money transfer app with strong encryption and safety features will help protect your information.

Also, check the app’s customer service options. Good support can make a big difference if you encounter problems during a transfer.

Transaction limit is another crucial factor. Some apps have lower limits that may not suit transferring large amounts.

Finally, compare fees and payment methods. Apps may charge different fees depending on how you fund your transfer—bank transfer, debit card, or credit card. Consider these factors to choose an app that fits your needs and budget.

Sending money overseas requires signing up for an international money transfer app like Wise or WorldRemit. Then, enter the recipient’s details, choose the amount to send, and select a payment method. Once you confirm the transfer, the app will handle the currency conversion and send the money to your recipient’s bank account or mobile wallet.

The cheapest way to send money internationally is often through global payment apps. These apps use exact exchange rates and charge low fees, especially when you pay directly from your bank account. Avoid using credit cards, as they usually come with higher charges.

International money transfers can take a few minutes to several days, depending on the app and the transfer option.

The best payment app for international money transfers largely depends on your needs. Wise is great for low fees and transparent exchange rates, while Remitly offers fast transfers with flexible delivery options. WorldRemit is a solid choice for cash pickup.

You can receive international money transfers directly to your bank account, mobile wallet, or cash. Depending on the app and method, the sender will use an international money transfer app to send the funds, and you can pick up the money at a bank or authorized location.

International money transfer apps have made it incredibly easy to send money across borders without the need for lengthy bank processes.

Choosing the best money transfer app depends on your needs. Wise is best for low-cost transfers, PayPal is great for convenience, Remitly excels in speed, Western Union is ideal for cash pickups, and Revolut is perfect for multi-currency spending.

Before sending money, verify the recipient’s information and compare fees, exchange rates, and transfer times. These will ensure you get the best deals and enjoy a hassle-free experience!

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.