Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Gift cards are one of the easiest ways to send money to someone who doesn’t have a bank account. They work like prepaid cards, preloaded with a set amount of money that the recipient can use for purchases at specific stores or online.

But how exactly does the process work? Sending a gift, helping a friend, or using gift cards for transactions is easier than you might think.

In this guide, we’ll walk you through how to send money using gift cards, the different types available, and what to consider for a smooth and secure transaction.

Sending money through gift cards is a simple and convenient process, whether the recipient has a bank account or not. It provides flexibility, security, and ease of use for both sender and receiver. Follow this step-by-step guide to send money using gift cards efficiently.

If you’re using the Nosh platform to buy and send a gift card, open the app and log into your account. If you don’t have the app, you can download it and sign up before proceeding.

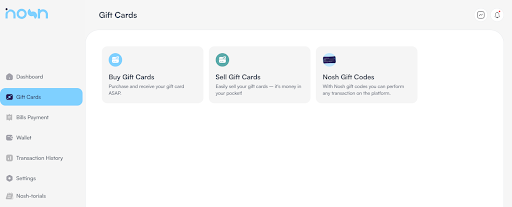

On the app’s homepage, locate and click on the “Gift Cards” option. From the list of options that appear, select “Buy Gift Cards.”

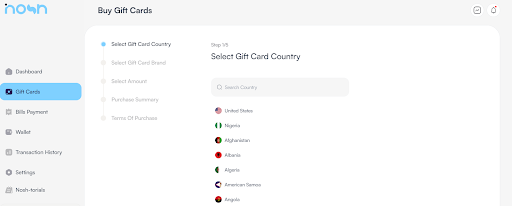

Gift cards are often region-specific, which means Amazon UK can’t be used on Amazon AU website. It’s important to choose the correct country where the card will be used. If your recipient is in the United States, select “United States” as the gift card country.

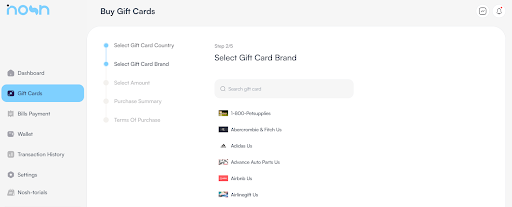

After selecting the country, browse the available options and choose the gift card brand that best suits your recipient’s needs. This could be Amazon, iTunes, Steam, Google Play, or any other preferred brand.

Some gift cards are store-specific, meaning they can only be used at certain retailers, while others, like Visa or Mastercard gift cards, are more versatile and can be used anywhere they are accepted.

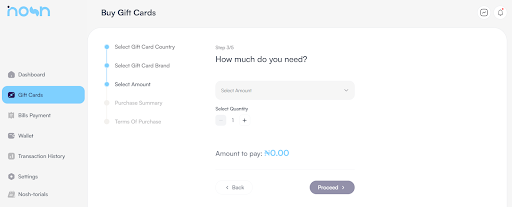

Specify the amount you want to load onto the gift card and the quantity of gift cards you wish to purchase. The total price will be displayed, helping you review the cost before proceeding.

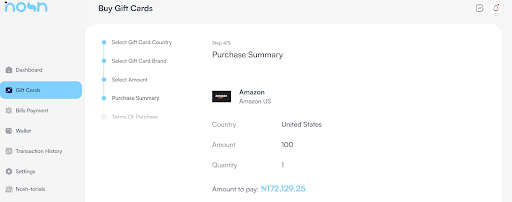

Click “Proceed” to review your order. Double-check the purchase summary to ensure all details are correct before making the payment. Once confirmed, complete the transaction.

Once your transaction is successful, an e-code (electronic code) for the gift card will be displayed. Copy this code and send it to your recipient via email, text message, or any other preferred communication method.

If you prefer not to send a digital gift card via an e-code, a physical gift card is a great alternative. It works the same way but comes in a tangible form that can be used for in-store or online purchases.

You can buy physical gift cards from:

Let’s talk about some of the advantages of sending money to someone using gift cards. Here are some of the benefits:

No, you can’t withdraw money directly from a gift card or use it at an ATM. However, you can sell it for cash.

There are several ways to turn a gift card into money. You can sell it online through gift card exchange websites or online marketplaces, or sell it to friends or family. Also, you can exchange it for cash at a gift card kiosk.

In Nigeria, you can convert your gift card to cash on Nosh, a gift card trading platform. Nosh allows you to sell your unused gift card at high rates and get paid in Naira instantly.

Yes, but it depends on the gift card provider. Some gift cards are region-locked and can only be used in specific countries. Make sure to check before purchasing.

The best gift cards for sending money are Visa, Mastercard, and American Express prepaid gift cards since they can be used anywhere those networks are accepted. Store-specific gift cards like Amazon, Walmart, or Apple can also be useful, depending on the recipient’s needs.

Some prepaid gift cards, such as Visa or Mastercard, may have activation or transaction fees. Store-specific gift cards usually do not have additional fees.

Digital gift cards are usually sent instantly, while physical gift cards may take a few days to be delivered, depending on the shipping method chosen.

Some platforms allow you to transfer funds from a gift card to a PayPal or Venmo account, which can then be withdrawn to a bank account. However, this depends on the type of gift card and the platform used.

If a gift card is lost or stolen, contact the issuer immediately. Some brands allow you to replace a lost card if you have the receipt or proof of purchase.

Always purchase gift cards from reputable stores, official websites, or authorized resellers to avoid scams or counterfeit cards.

To sum it all up, sending money using gift cards is a pretty straightforward process. You can decide to use an open-loop gift card like my uncle did with the Visa gift card, or use a retailer-specific gift card.

Whatever gift card you decide to use, these prepaid cards can be used to facilitate money transfers across borders or simply to provide financial assistance to friends and family.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.