Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

I used to find the concept of credit cards funny because they seemed quite risky and unnecessary to me. I honestly wondered why anybody in their right mind would choose to borrow money using a credit card when they could pay with their money using a debit card.

But I was wrong. As I learnt more about credit cards, I understood their appeal. There are many benefits to using your credit cards wisely. You can enjoy rewards and build your credit score while enjoying the convenience of credit cards. By using credit cards responsibly, you can establish a good credit history, which is crucial for future financial opportunities.

In this article, I’ll share with you some tips on how to make the most of credit cards, so you can take advantage of these benefits without negatively affecting your finances. Let’s get to business!

Credit cards, not to be confused with debit or gift cards, are physical cards that allow you to borrow money from a bank or credit card issuer to make purchases. You can spend up to a certain credit limit, which is determined by the issuer based on your creditworthiness and income.

Each month, you will receive a bill or statement that shows your total balance and minimum payment due. If you pay off the full balance by the due date, you won’t be charged any interest. Otherwise, the issuer will charge you interest on the remaining amount. This is called the Annual Percentage Rate (APR).

Credit cards also offer benefits like rewards points, cashback, or travel perks for using them. They are widely accepted for both online and in-person purchases, providing convenience and security compared to cash.

It’s important to use credit cards responsibly by making payments on time and keeping your balance manageable. This helps build a good credit history and avoids costly interest charges.

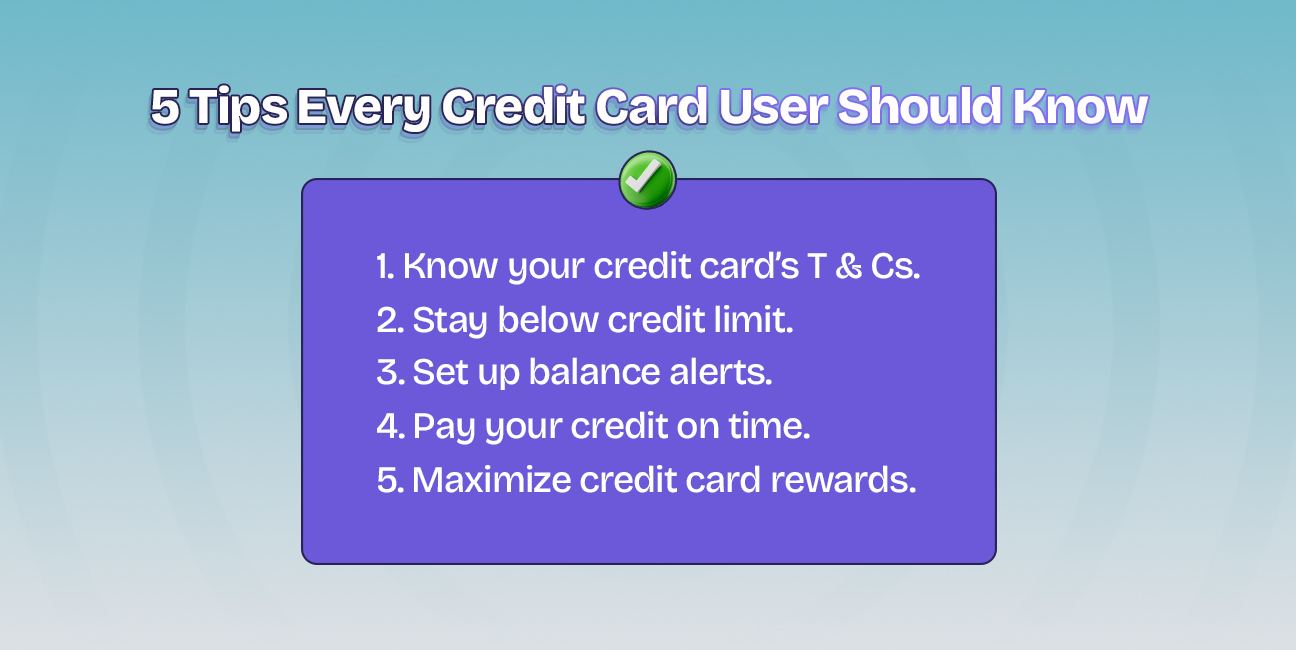

Here are 5 credit card tips you should keep in mind for responsible credit card usage:

Now, let me explain each of these credit card tips in detail.

It’s important to understand what you’re signing up for when you get a credit card. This credit card tip seems obvious but not everyone takes the time to go through T & Cs. Read through the terms and conditions provided by the card issuer to know what using their card entails.

This includes knowing the interest rate (APR) charged on balances, fees for late payments or exceeding your credit limit, and any rewards or benefits offered by the card issuer. By being aware of these details, you can make informed decisions about how and when to use your card to avoid unnecessary charges.

Your credit limit is the maximum amount you can borrow on your credit card. It’s advisable to keep your spending well below this limit. Try to keep your spending limit below 30% of your total credit limit.

This practice not only helps you avoid over-limit fees but also keeps your credit utilization ratio low. Credit utilization is the percentage of your credit limit that you’re using, and keeping it low can positively impact your credit score.

Tracking your spending when using a credit card might be a hassle especially if you’re used to using cash. However, many credit card issuers offer the option to set up balance alerts via email or text messages. These alerts notify you when your balance reaches a certain level that you’ve set or when your payment is due.

By setting up these notifications, you can monitor your spending closely and ensure timely payments. This helps you avoid late fees and maintain good financial habits. Additionally, you should create a budget to help you keep your spending in check.

Next on the list of credit card tips is paying your credit bill promptly. Making timely payments on your credit card is essential for several reasons. Firstly, it helps you avoid late payment fees and penalty interest rates, which can quickly add up and increase your overall debt.

Secondly, paying on time positively impacts your credit score. This demonstrates responsible credit management to potential lenders. To ensure prompt payments, consider setting up automatic payments or reminders. Additionally, try to pay in full or above the minimum amount if you can.

Many credit cards offer rewards such as cashback, points, or travel miles for every dollar spent. To maximize these rewards, use your credit card for everyday expenses and bills. Some card issuers may also offer bonus categories that earn higher reward rates for specific purchases, such as groceries or dining.

Moreover, check your card issuer’s website to know if there are any promotions currently going on. While maximizing your credit card rewards, try to pay off your balance in full each month to avoid interest charges. This way, you can fully enjoy the benefits of your rewards program without accruing debt.

1. What is a credit card?

A credit card is a plastic card issued by banks or financial institutions that lets you borrow money to make purchases. You can use it to buy goods and services up to a certain limit and pay back the borrowed amount later. Note that you will pay back with interest if you don’t pay the full balance each month.

2. Can I withdraw cash from my credit card?

Yes, you can withdraw cash from your credit card, it is called a cash advance. However, it often comes with high fees and interest rates, which start counting immediately. It’s usually more expensive than using your credit card for purchases.

3. Can I send money from my credit card to a bank account?

Yes, you can send money from your credit card to a bank account. It’s similar to a cash advance and can be costly as well. This service usually involves high fees and interest rates, so it’s better to use other methods, like a debit card or bank transfer, if possible.

4. How can I check my credit card balance?

You can check your credit card balance in several ways. Log in to your online banking account or mobile app, call the customer service number on the back of your card, or check your most recent statement. Some ATMs also provide balance information when you insert your card and enter your PIN.

5. How do I know if my credit card is active?

To know if your credit card is active, check your account status online or through your card issuer’s mobile app. You can also call the customer service number on the back of your card to ask if your card is active. Additionally, you can try making a small purchase to confirm it is truly active.

In conclusion, credit cards can be powerful financial tools when used responsibly. From earning rewards to building a solid credit history, the benefits are numerous. However, it is essential to understand how they work and how to use them wisely.

By knowing your card’s terms and conditions, staying below your credit limit, setting up balance alerts, paying your bill on time, and maximizing rewards, you can make the most of your credit card without falling into debt. Keep these credit card tips in mind, and you’ll be well on your way to leveraging them for financial success.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.