Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Scam investment apps have become more common in Nigeria, they trick users with promises of high returns and then disappear with their money. It’s more important now than ever to stick with platforms that are trusted and properly regulated.

Apps like Risevest, PiggyVest, Bamboo, and Cowrywise have built strong reputations by offering secure, transparent investment options. They make it easy to start small and grow steadily.

This guide covers seven of the best investment apps you can use in 2026 to build wealth, avoid fraud, and take control of your financial future.

Investment apps make earning money online in Nigeria easier than the traditional method of buying stocks or bonds, which often involves paperwork and physical visits to institutions or brokerage firms.

Let’s take a look at the top 7 investment apps in Nigeria I recommend:

Next, we will examine each investment app one after the other.

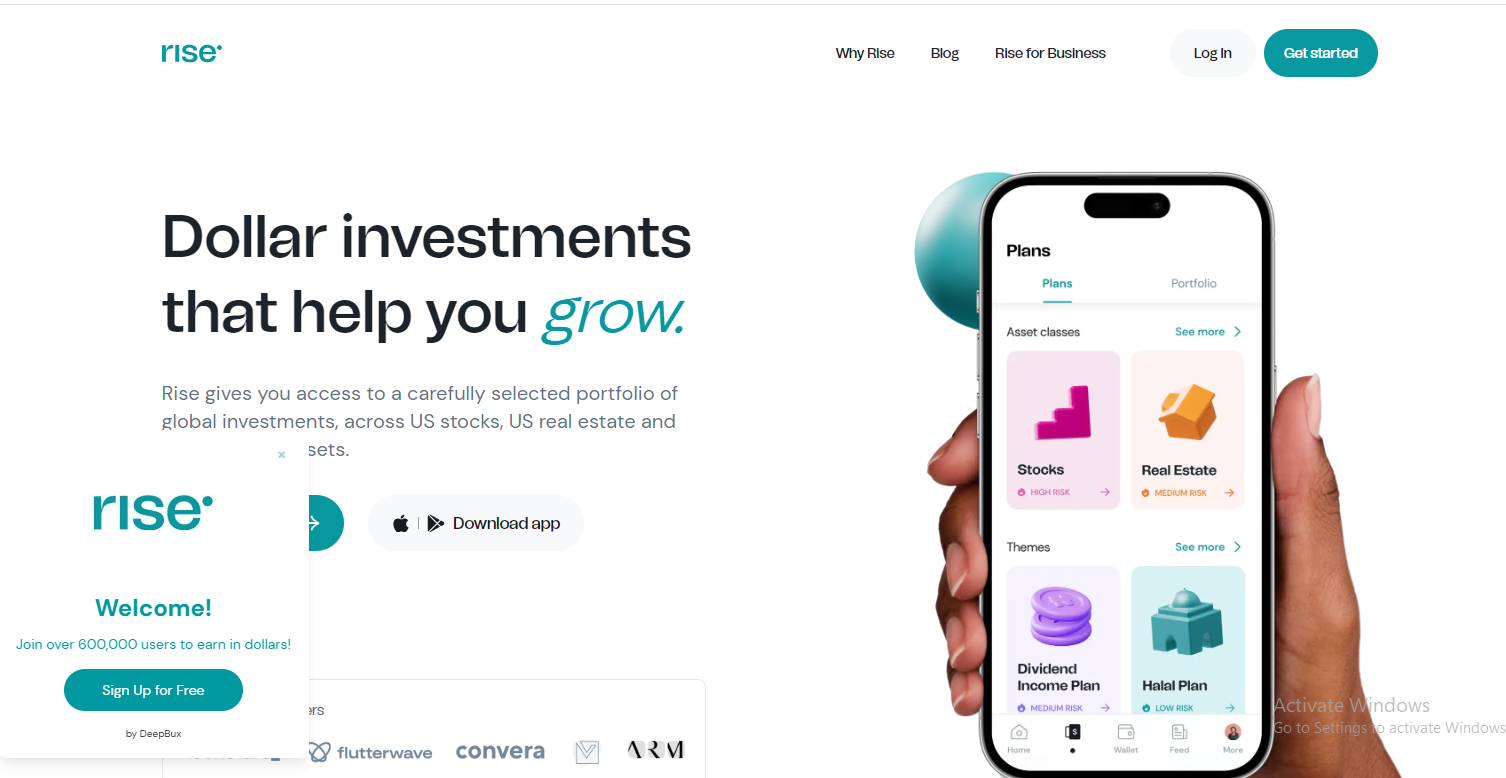

Risevest is a Nigerian investment platform that allows users to grow their wealth by investing in U.S. dollar-denominated assets, including stocks, real estate, and fixed income. Risevest offers expertly managed portfolios, so you don’t need to be an investment guru to get started.

Minimum investment: $10 (approximately ₦15,000–₦17,000)

Investment Portfolios

Expected Returns

Bamboo is a stock trading app that gives Nigerians real-time access to over 3,000 U.S. stocks, ETFs, and Nigerian equities. It is ideal for users who want to handpick and manage their own investment portfolio across local and global markets.

Minimum investment: $2 (approx. ₦3200–₦3,000)

Investment Portfolios

Expected Returns

Chaka is a digital investment platform that lets Nigerians invest in over 4,000 assets, including stocks, ETFs, and fixed-income products across U.S., Nigerian, and global markets. It offers direct market access through its partnerships with licensed brokers.

Minimum investment: ₦1,000 or $10 (depending on asset type)

Investment Portfolios

Expected Returns

Trove gives Nigerians access to thousands of assets across U.S., Nigerian, and Chinese markets. The platform is ideal for investors who want flexibility and a wide range of instruments, from stocks to government bonds.

Minimum investment: ₦1,000

Investment Portfolios

Expected Returns

Cowrywise is a fintech app that helps Nigerians build disciplined financial habits through automated savings and curated investment plans. It gives access to both Naira and Dollar mutual funds managed by top asset managers in Nigeria.

Minimum investment: ₦100

Investment Portfolios

Expected Returns

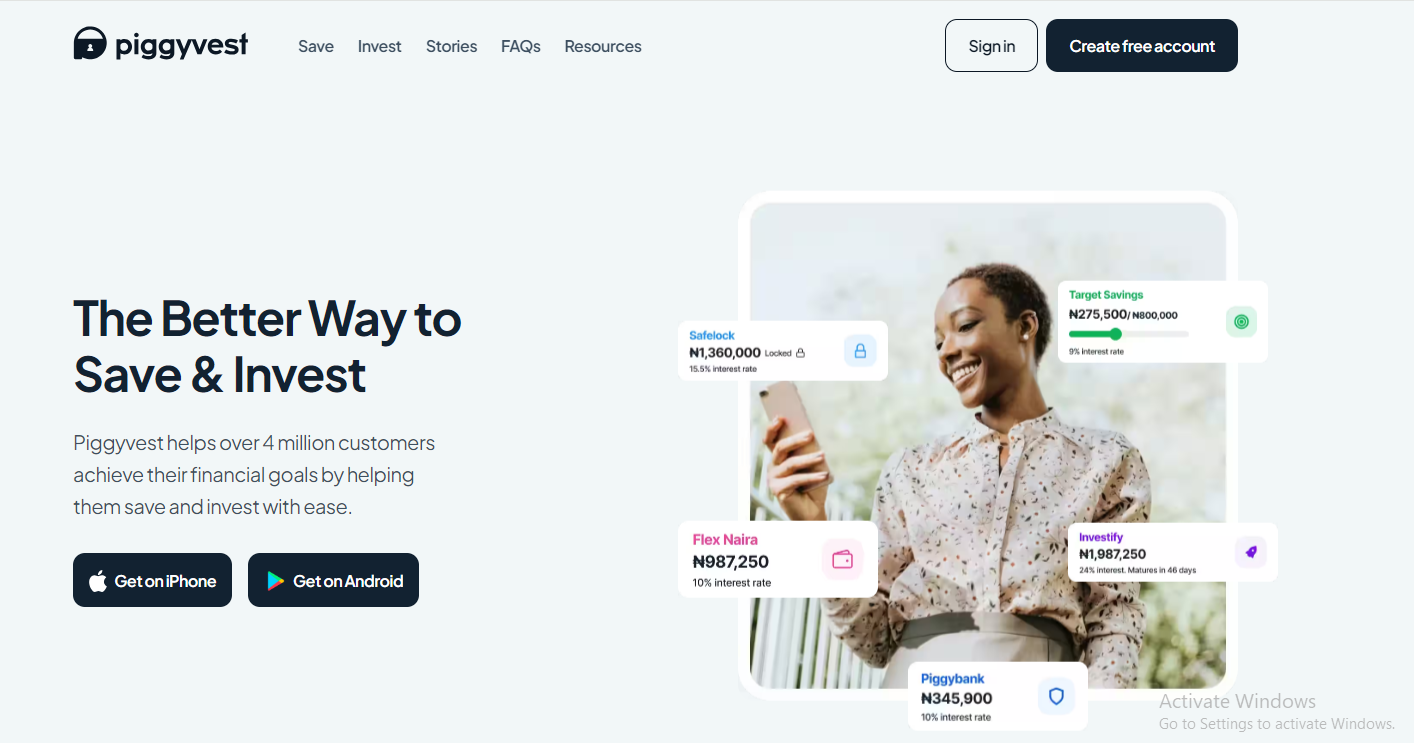

PiggyVest is a popular savings and investment platform that helps Nigerians automate their finances and grow wealth over time. It combines fixed savings tools with access to pre-vetted, low-risk investment opportunities.

Minimum investment: ₦5,000

Investment Portfolios

Expected Returns

I-Invest is a mobile investment platform that allows Nigerians to buy treasury bills, fixed deposits, and other fixed-income securities directly from their smartphones. It’s ideal for conservative investors who prioritize safety and predictable returns.

Minimum investment: ₦100,000

Investment Portfolios

Expected Returns

The popularity of an investment app doesn’t automatically make it the right choice for you. It must check key boxes like fund safety, ease of access, and alignment with your financial goals to truly be the best fit.

Here are some key factors to consider when selecting an investment platform in Nigeria:

Many investment apps in Nigeria operate in partnership with licensed financial institutions regulated by the Securities and Exchange Commission (SEC) or the Central Bank of Nigeria (CBN). However, it’s essential to verify the regulatory status and partnerships of each app before investing.

Savings apps primarily focus on helping users set aside money, often with fixed interest rates and limited risk. Investment apps, on the other hand, allow users to allocate funds into various assets like stocks, bonds, or mutual funds, which can offer higher returns but come with associated risks. Some platforms, such as PiggyVest and Cowrywise, offer both savings and investment features.

Yes, investment earnings in Nigeria, such as dividends and interest income, may be subject to withholding tax. The specific tax implications can vary based on the type of investment and current tax laws.

Yes, investing inherently carries risks. While platforms like Risevest, Trove, and Bamboo provide access to real assets, the value of investments can fluctuate based on market conditions. It’s crucial to assess your risk tolerance and diversify your investment portfolio accordingly.

Most investment apps in Nigeria allow users to withdraw funds directly to their linked bank accounts. The processing time for withdrawals varies by platform: for example, PiggyVest and Cowrywise typically process withdrawals within 24 hours, while platforms like Bamboo may take 1–3 business days.

If an investment app ceases operations, the safety of your funds depends on the app’s structure and regulatory compliance. Apps that operate in partnership with licensed financial institutions often have custodial arrangements to protect user funds.

Investing is easier than ever with reliable apps now widely available. Beginners and experienced users alike can find options that fit their goals. Risevest offers access to dollar-based assets, while PiggyVest combines savings tools with solid investment opportunities.

The right platform can help you start strong or take your investing to the next level. So, choose based on ease of use, security, fees, and available investment options.

To get more financial information, advice or tips, feel free to go through the various articles on Noshers’ blog.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.