Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever had to stand in a long queue at a bank, just to perform a simple transaction that should take five minutes? Or maybe you’ve tried opening a business account, only to be told you need a utility bill, a referee, or some document you’ve never even heard of.

Trust me, I’ve been there too. As someone who runs a small online business in Nigeria, I know firsthand how stressful traditional banking can be.

That’s where virtual bank accounts come in, and honestly, they’ve made a huge difference for me. You can collect payments and manage your business cash flow without stepping into a physical bank.

In this guide, I’ll walk you through how virtual bank accounts work in Nigeria, how to open one, and what to watch out for when choosing among the many virtual account providers in Nigeria.

| Feature | Virtual Bank Account | Traditional Bank Account |

| Account Opening | Done online in minutes | Requires physical visit, paperwork, utility bill |

| Documentation | Usually just BVN and NIN, sometimes facial scan | BVN, NIN passport photo, utility bill, referees |

| Account Maintenance Fees | Mostly free or zero maintenance fees | Often ₦50/month or more (plus SMS charges) |

| Transfer Fees | Many offer free transfers up to a certain limit | ₦10–₦50 per transfer, depending on the bank |

| Customer Service | In-app chat or email, usually faster response | In-branch or via slow helplines |

| Access to Loans | Digital credit scoring, faster loan approval | Limited and requires collateral or a lengthy process |

| Integration Options (API) | Built-in APIs for fintechs and SMEs | Rare or only available for large corporates |

| Virtual Account Availability | Available instantly upon sign-up | Not available |

| Business Use | Some allow business use even without CAC | Requires business registration, CAC, tax ID |

| Flexibility & Mobility | Limited to banking hours and branch access | 24/7 access via phone or laptop |

Virtual banks, sometimes called digital banks, are financial institutions that operate entirely online without any physical branches.

Unlike traditional banks, where you have to walk in, fill out forms, and wait in line, virtual banks allow you to manage your money using just your smartphone or computer.

Everything from opening an account to requesting a debit card is done digitally. And yes, these banks are licensed and regulated, so they’re legit and safe to use.

In Nigeria, virtual banks have become very popular among freelancers, online vendors, and small business owners because they offer fast and convenient banking.

Most of these platforms also partner with licensed commercial banks to provide services like virtual account numbers, BVN linking, and loan offers. The best part? You can open an account in minutes, no utility bill wahala, and no unnecessary stress.

Here are some common and trusted virtual banks in Nigeria that you’ve probably heard of, or should definitely check out if you haven’t yet:

Often referred to as “the bank of the free,” Kuda is one of the most popular virtual banks in Nigeria. They offer zero maintenance fees, free transfers (up to a limit), and tools to help you save automatically. It’s great for individuals and small businesses.

Originally known for mobile payments and ride-hailing, Opay has grown into a full-blown digital banking service. They offer virtual account numbers, POS terminals for merchants, and bill payments all through their app.

While it’s more known for serving POS merchants, Moniepoint also provides virtual banking solutions. It’s useful if you’re looking for payment collection solutions or tools to manage your daily transactions.

This is another mobile-first banking platform that’s grown quickly across Nigeria. PalmPay offers virtual accounts, fast transfers, and cashback rewards when you use their app for airtime, data, or bill payments.

Carbon started out offering digital loans but now provides full virtual banking services. You can get a virtual account, request a debit card, pay bills, and build your credit score, all from one app.

Related Article: How To Save in Dollars in Nigeria in 2025 – A Detailed Guide

There are 3 basic ways virtual banks work, and it all begins with account creation. Let’s look at them here:

Getting started with a virtual bank in Nigeria is surprisingly easy and way faster than opening an account at a traditional bank. Here’s a step-by-step breakdown of how it usually works:

That’s it. No paperwork. No, “come back tomorrow.” Just download, sign up, and you’re done in minutes.

Once your virtual account is up and running, you can start using it just like a regular bank account. You can:

Many businesses in Nigeria use virtual bank accounts for automated payment collection. API integration means you do not have to manually provide your account number and confirm payment each time you want to get paid. This will be handled for you automatically.

Here’s how it works:

This setup significantly reduces manual work and improves how efficiently you collect payments. While virtual account integration costs vary depending on the provider and volume, it’s generally affordable, especially compared to hiring staff to manually check transfers.

Here’s a list of the benefits and downsides of virtual banking:

Also read: A Comprehensive Report About Virtual Dollar Cards in Nigeria

Yes, your money is safe as long as you use a licensed and regulated virtual account provider in Nigeria. Most virtual banks partner with licensed commercial banks and are regulated by the CBN. Just make sure to secure your app with a strong password and enable two-factor authentication (2FA).

Absolutely. Your virtual account comes with a regular Nigerian account number, which means anyone can send you money, whether it’s your employer, a client, or a friend.

If you lose your phone, your money isn’t lost. You can simply log into your virtual bank account on another device using your details. Just be sure to report the lost device to your provider and reset your login details immediately for safety.

Yes, many virtual banks offer small personal or business loans. Some use your transaction history or BVN credit score to determine how much you can borrow. For example, Carbon and FairMoney are known for quick, app-based loan approvals.

Yes, you can use a virtual bank for your small business. Many virtual banks support business payment collection and offer custom accounts for your customers. Some platforms also provide APIs for easier integration with your website or app.

Virtual banking is a practical solution for real-life banking stress. Whether you’re tired of bank queues or just need a smarter way to run your hustle, virtual accounts give you the control and convenience that traditional banks often lack. So if you’ve been thinking about making the switch, go for it. You don’t have to close your regular bank account right away. Just open a virtual one, test it out for your transfers, and see how it fits into your lifestyle.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

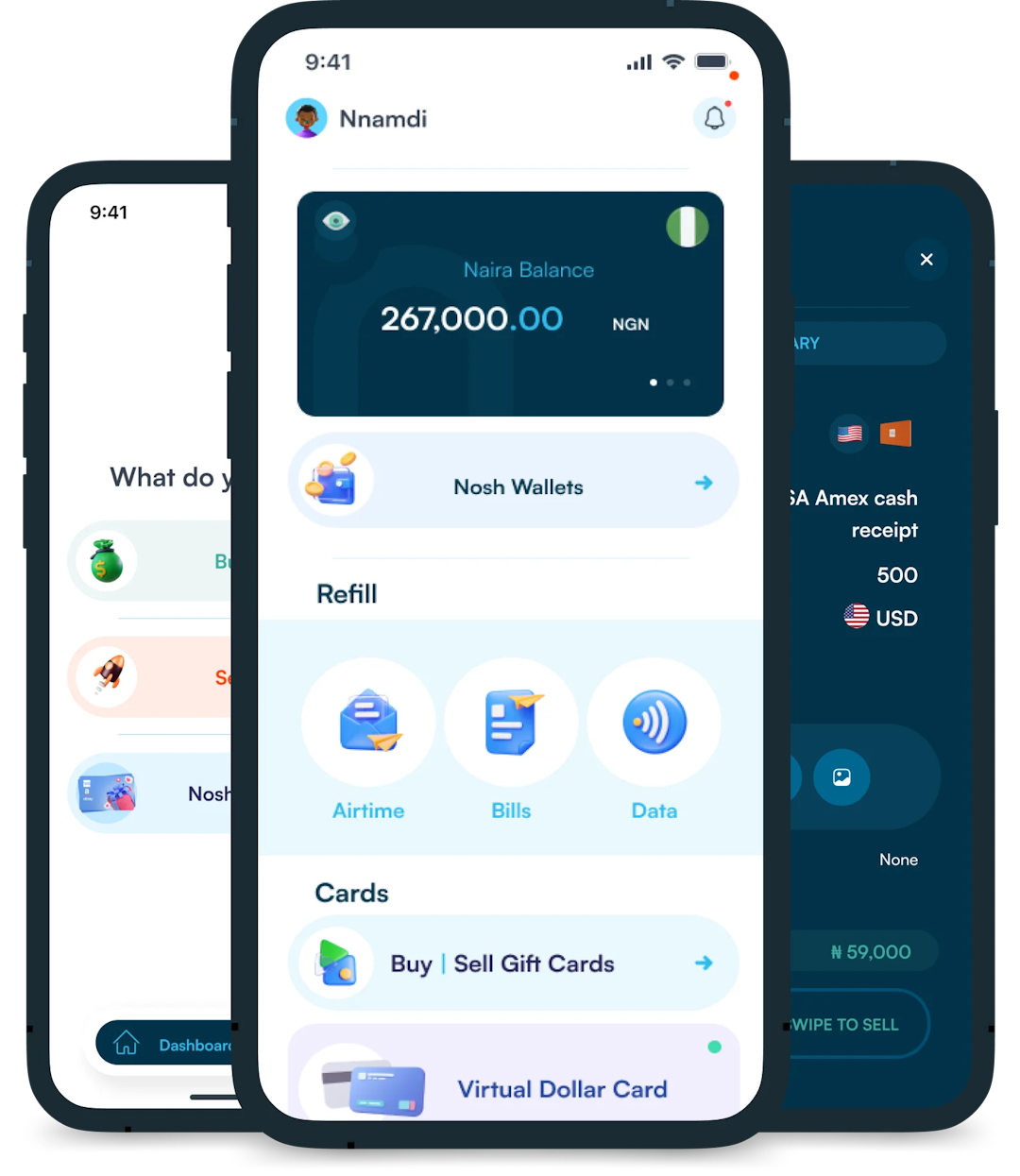

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.