Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Ever tried receiving money from abroad while living in Nigeria? Then you’ll know how stressful the process is. This is because some payment platforms have restrictions with processing payments to and from Nigeria, high fees for international transactions, plus unstable exchange rates.

However, it’s not all gloom because there are still some reliable methods for receiving foreign payments, which will be the focus of this article. So, stick with me till the end as I walk you through five reliable ways to receive international payments in Nigeria.

Here are the top five ways you can receive global payments in Nigeria in 2025:

Now, it’s time to learn more about these methods.

Remittance services like MoneyGram, Western Union, WorldRemit, and Remitly are popular for receiving money abroad, especially amongst the older population. They let people send funds from one location to another. To use these services, the sender goes to a MoneyGram or Western Union office or uses their online platform. Then, they provide the recipient’s details and the amount to send.

Typically, it takes 1-5 days for money to get to Nigeria via this method. The recipient can then collect the money in foreign currency or the naira equivalent from the partner bank. The process is straightforward, but there are fees attached.

Gift cards are another way you can receive international payments in Nigeria. Instead of receiving your funds in fiat currency, you get the equivalent in gift cards. The good thing about this method is that there are no transaction fees or wait time involved.

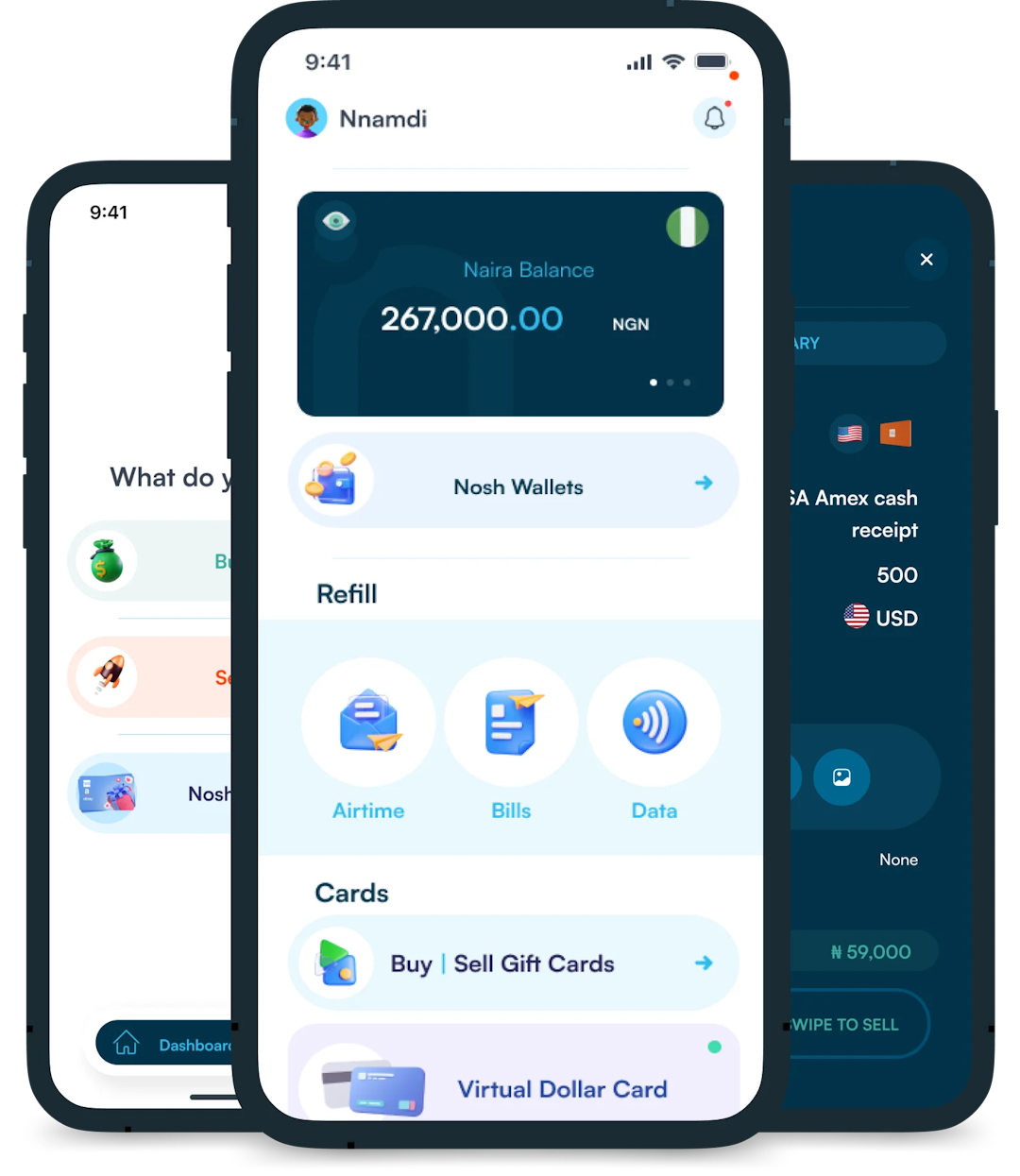

The sender buys a gift card for a store or platform like Amazon or an open-loop gift card like a Visa gift card and sends the card details to you via email or text. You can then use the card to shop online or sell it for cash on Nosh. You can decide not to use or sell your card and keep it as a store of value. If the conversion rate of the gift card increases when you’re ready to sell it, you gain some money.

To use this method, it is recommended to make sure the gift card is for a retailer or platform you can use. However, if it is not, you can always trade it on platforms like Nosh.

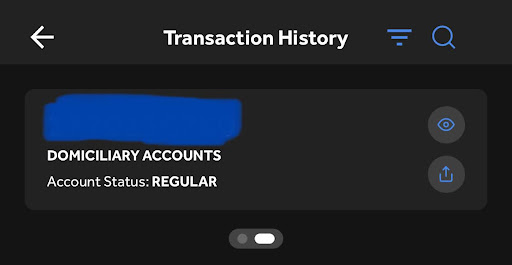

A domiciliary account is a type of bank account in Nigeria that holds foreign currencies like Dollars, Euros, or Pounds. You must open a domiciliary account with your bank to use this method. Once you have your bank account details, share them with the sender. When they send money, it will go directly into your domiciliary account in that foreign currency.

To withdraw the money, you can do either of the following:

For the latter option to work, you’ll first have to go to your bank for them to enable the feature on your bank app. This method is useful for receiving large sums and avoids high conversion fees that might apply to other methods. However, it may require more paperwork for setting up.

Cryptocurrency offers a fast and easy way for people to receive payments from anywhere. To use this method, decide on a coin to use. Stablecoins like USDT or USDC are good options. The sender transfers the cryptocurrency equivalent of the money to your crypto wallet. You can then convert it to Naira or keep it as cryptocurrency. Depending on the amount and platform used, transaction fees might be involved.

You could also use coins like Bitcoin or Ethereum to leverage their price fluctuations. You make a profit if you sell your Bitcoin when its worth is higher than when you received it. However, you can be at a loss if the cost of the coin drops.

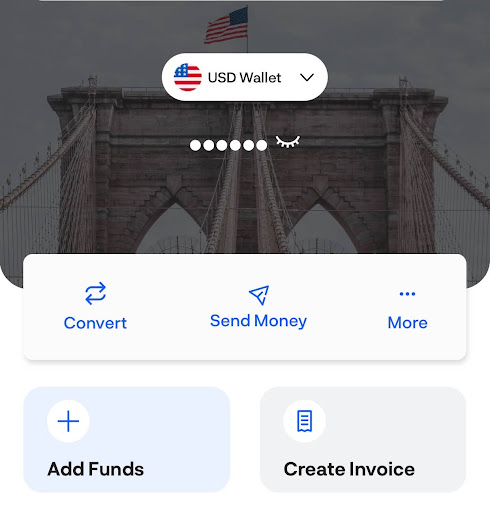

Popular cross-border payment apps like PayPal, Wise, and Payoneer make it easy to receive international payments. However, they no longer work in Nigeria due to some regulatory issues.

Fortunately, Fintechs like Grey, Geegpay, and Cleva have come to the rescue and simplified the process of receiving global payments in Nigeria. Its convenience and user-friendly interface have made it a favorite for its users, particularly freelancers.

These apps generate a virtual foreign bank account that you can use to receive payment from various sources.

You can then convert and transfer the funds to your Nigerian bank account or use the money in the app to make foreign payments. They also offer competitive exchange rates and lower fees than traditional banks.

| Payment method | Bearer of transaction fees | Account setup | Processing time | Withdrawal options |

| Remittance services | Borne by the sender | No need to sign up on any platform | 1-5 days | Local bank account |

| Gift cards | No fees attached | Sign up on gift card trading platform | Almost immediately | Local bank account |

| Domiciliary account | Borne by sender and recipient in some instances | KYC documents and signatures from references | 24 hours – 72 hours | Local bank account or cash |

| Cryptocurrency | Borne by both parties | KYC document upload on crypto platform | A few minutes to 48 hours | Crypto wallet or local bank account |

| Cross-border payments | Borne by the recipient | KYC documents and biometric details | A few hours – 3 business days | Virtual bank account |

Challenge 1: Transaction Fees

This is due to the different parties involved in approving cross-border transactions and converting foreign currencies. Hence, every international payment comes at a cost, which leaves a dent in the overall sum the receiver ends up with.

Solution

Opt for a method with lesser fees based on your relationship with the recipients. For payments from friends and family, gift cards, cryptocurrency, and cross-border payments are best.

Challenge 2: Unfavorable exchange rates

Different platforms offer different exchange rates, which benefits them but is unfavorable to yo,u the recipient. This disparity can also be due to currency fluctuations in market demand for different currencies.

Solution

You can opt for third parties like BDCs to help convert your money or have different methods you work with based on the exchange rate they offer. Plus, as long as your medium for receiving money is legal, and with currencies like USD and EUR being stronger than the naira, you’re not really at a loss.

Challenge 3: Payment Delay

This stems from the strict regulations the Central Bank of Nigeria has in place to control forex inflow and the activities of scammers. Plus, checks Fintechs run to certify the authenticity of every international transaction.

Solution

While this challenge is for the benefit of all who participate in international transactions, the best way to reduce wait time is by having the necessary details to prove your identity and help regulatory bodies track every inflow.

To receive international payments in Nigeria, you can use various methods. Popular options include remittance services like Western Union and MoneyGram, domiciliary accounts, gift cards, cryptocurrency, and cross-border payment apps like Cleva and Grey.

Most banks in Nigeria can receive foreign currency through domiciliary accounts. Major banks such as First Bank, Zenith Bank, and Access Bank, to mention a few, offer domiciliary accounts that allow you to receive, hold, and manage foreign currencies like dollars, euros, or pounds.

Apps like Grey, Cleva, Sentz, and Geegpay are great for receiving foreign currency in Nigeria. These apps allow you to receive international payments and manage funds easily. They often provide competitive exchange rates and lower fees compared to traditional banks.

You can use gift card trading platforms like Nosh to convert your gift card to cash in Nigeria. Nosh allows you to sell your gift card for cash at high rates. Once you sell your gift card, you’ll receive the equivalent amount in Naira.

Yes, through remittance services and gift card sales.

Receiving international payments in Nigeria doesn’t have to be stressful or complicated. With the right method, you can easily access your funds from abroad. To receive foreign currency, use remittance services, gift cards, domiciliary accounts, cryptocurrency, or cross-border payment apps.

To find the best method for you, consider factors like fees, transfer speed, and convenience. Remember, if you have gift cards you want to convert to Naira, you can download Nosh to trade.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.