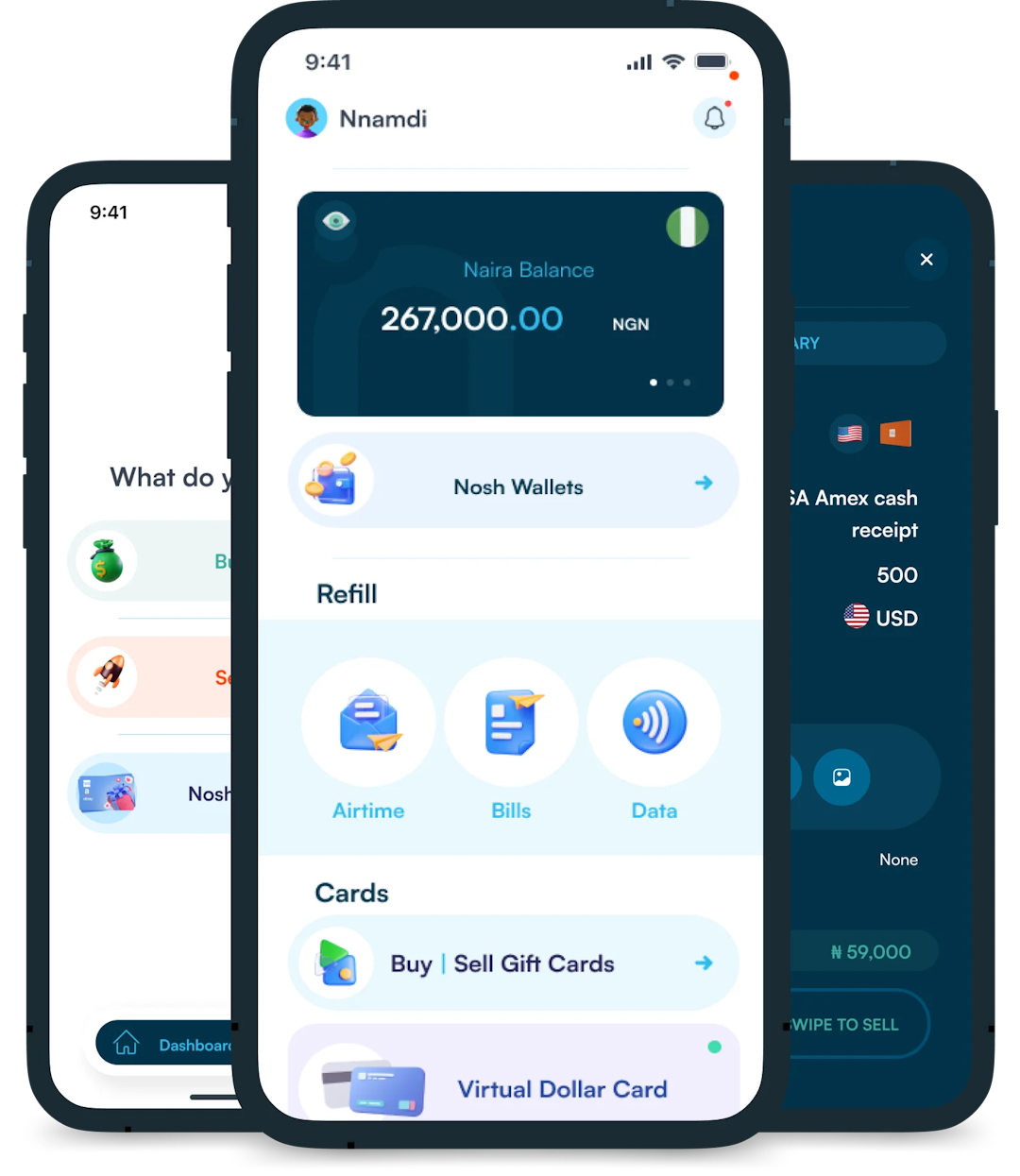

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Like other mobile payment apps, Cash App and Venmo have become household names in the United States, especially among young adults who want fast and easy ways to send and receive money.

Cash App focuses on simplicity, investment options, and user privacy, while Venmo is built around social interaction and effortless bill-splitting. At their core, however, both apps offer similar functionality, like peer-to-peer payments, instant transfers, and debit card support.

This article compares both platforms across key features like security, fees, speed, and business tools to help you decide which one is better for your needs.

Cash App and Venmo offer similar services but differ in how they deliver them. Below is a breakdown of their core features, including security, fees, interface, transaction speed, and business tools, to show how each app compares.

Both apps utilise advanced security features like multi-level encryption, two-factor authentication, security locks, and anti-fraud technologies to protect users’ personal information and funds.

Additionally, Cash App offers an extra layer of security by allowing users to set a PIN or fingerprint identification for app access.

Cash App charges 0.5% to 1.75% for instant transfers (minimum $0.25), while standard transfers are free. Sending money with a credit card has a 3% fee, and ATM withdrawals cost $2.50, unless you receive $300 or more in direct deposits, which waives the fee. Business accounts pay a flat 2.75% per transaction.

Venmo also charges 1.75% for instant transfers, with a $0.25 minimum and $25 maximum. Credit card payments have a 3% fee. ATM withdrawals cost $2.50 if you’re outside the MoneyPass network, but they’re free at MoneyPass ATMs. For business use, Venmo charges 1.9% plus $0.10 per transaction.

Both Cash App and Venmo offer interfaces that are easy to use. Venmo takes a more social approach with its news feed format, while Cash App has a simple design focusing more on functionality rather than aesthetics.

Venmo allows users to choose to make their transactions public or private, while Cash App focuses on simplicity and effectiveness.

Both payment apps provide immediate transfers to users within their network. However, Cash App has a slight edge with its “Instant Deposit” feature, enabling customers to quickly transfer money from their Cash App balance to their bank account for a small charge.

When it comes to spending limits, Venmo has a weekly spending limit of $299.99 until the account is verified, while Cash App has a limit of $250 per week. Once verified, Venmo allows users to send as much as $25,000 per week with a business profile.

On the other hand, Cash App also requires further identity verification to send or receive over $1,000 per month.

Both payment apps provide options for businesses to receive payments from customers. Venmo charges businesses a 1.9% fee plus $0.10 per transaction, while Cash App charges a 2.5% fee for transactions accepted and a 2.75% fee for credit card payments.

Furthermore, Cash App provides businesses with more advanced tools and features compared to Venmo. This includes real-time sales tracking and the ability to create invoices for clients. Venmo’s business features are more limited and primarily focused on personal use. Also, one should note that business accounts on Venmo are subject to tax reporting.

The better choice depends on your needs. Venmo is more social and intuitive for casual use, while Cash App offers stronger security features, investment options, and better tools for business users.

After downloading the app and setting up your account, you can send money by entering the recipient’s username, phone number, or email. When someone sends you money, you’ll receive a notification, and the funds will reflect in your balance instantly.

Both apps use encryption and two-factor authentication to secure user accounts. However, Cash App offers extra protection with features like a PIN or fingerprint lock for app access.

Yes, but you’ll need to link a debit card instead. Either a bank account or a debit card is required to send and withdraw funds.

You can’t add store-branded gift cards to either app. However, Venmo does allow certain payment network gift cards, such as Visa, Mastercard, or Vanilla, to be linked and used.

Cash App and Venmo both serve the same core purpose: quick and easy money transfers, but they cater to different user preferences.

Cash App is better if you’re focused on privacy, investment tools, or running a small business. Venmo, on the other hand, stands out for its social features, ease of splitting payments, and friendly interface that’s perfect for everyday interactions.

Ultimately, it’s important to consider your priorities and each app’s features to determine which of them best fits your requirements.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.