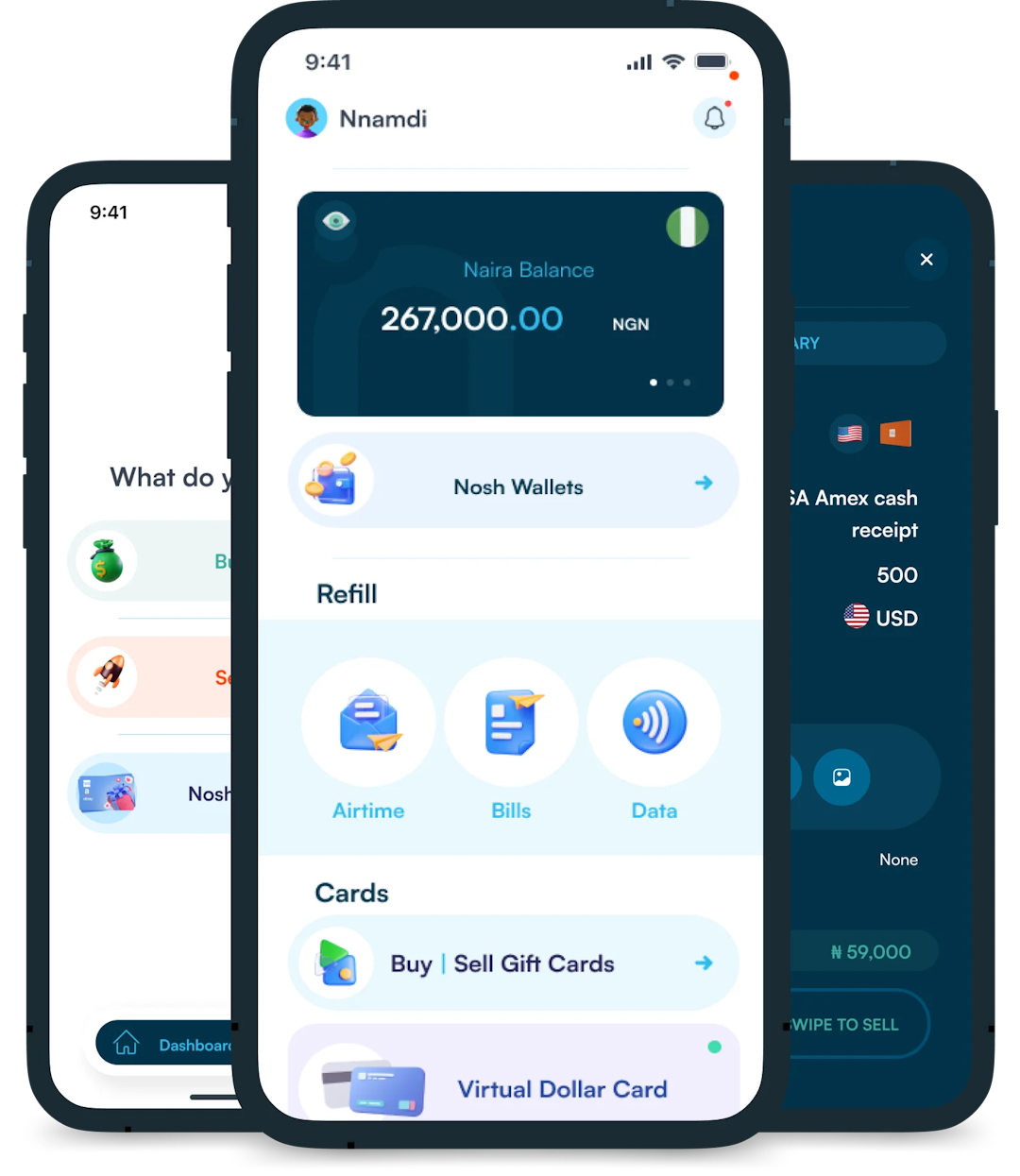

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

One of the advantages a business can have over another is having more than one easy payment option which is what Venmo makes available for its business accounts. Venmo is more than just a peer-to-peer mobile payment platform.

As a business owner, setting up a Venmo account for your business enables you to accept both contactless and in-person payments. Your customers can easily scan your printed QR code or phone. Venmo also allows you to tap into its over 90 million customer base while also ensuring swift and secured transactions.

If you’re ready to start accepting Venmo payments, this article will walk you through the simple steps to set up your Venmo Business account. You will also find helpful information like how to create a Venmo personal account and Venmo for business fees. First, let’s see what exactly a Venmo Business account is.

A Venmo business account is a type of Venmo account designed for small businesses and entrepreneurs to accept payments directly through the Venmo app. This allows businesses to receive payment from their customers who use Venmo without any third-party interference.

With this account, you can send invoices to Venmo users, track transactions, and even connect to e-commerce platforms. Venmo added this feature in 2020 in a bid to expand the payment service and accommodate more users. It makes it easy for businesses to manage payments and connect with Venmo’s large user base.

The following are the things you need to know and put in place before you start setting up a Venmo business account.

6. There are three verification levels:

Step 1: Go to the App Store if you have an iPhone or Google Play Store if you’re using Android. Download the Venmo app and install it.

Step 2: Open the Venmo app, click on “Sign Up”, fill in your personal details like your name, phone number (a US number), and email, and then set your password.

Step 3: A verification code will be sent to your mobile number via text. Enter the code into the space provided to verify your phone number.

Once that’s done, you have successfully created a Venmo account.

Creating a Venmo business profile is quite straightforward. The steps for setting up Venmo for business include:

Now, let’s take a look at each step of the process in detail.

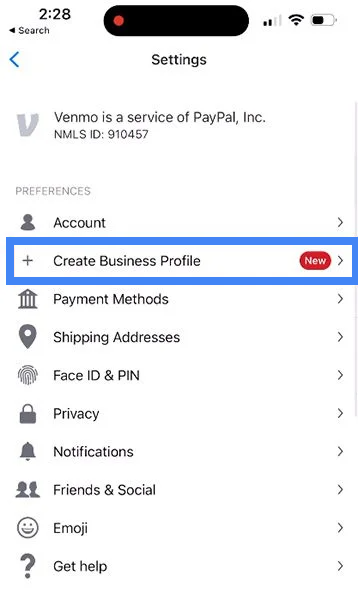

Step 1: Create Your Business Profile

After setting up your personal Venmo account, you can create a business profile. Tap on the menu (three lines in the upper corner) and select “Create Business Profile”. Venmo will ask for your business details such as the name of your business, the type of business, business description, address, and profile image. Fill in this information carefully, as it will appear on your profile when customers pay you.

Step 2: Verify Your Identity

Additionally, you will need to verify your identity by providing details like your legal name, date of birth, address, social security number, or individual tax identification number. You can also add your business website and contact details to your business profile.

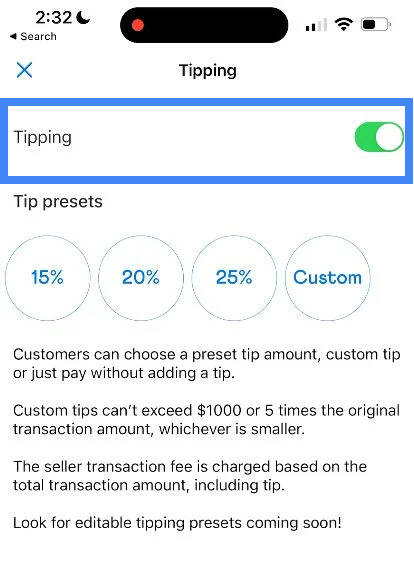

Step 3: Allow Tipping (Optional)

Venmo gives you the option to turn on tipping. This feature allows your customers to add a tip to their payment, which is useful for service-based businesses. To enable it, go to your business profile settings and toggle the “Tipping” option. You can even set a suggested tip percentage (15, 20, or 25 %) to make it easier for customers.

However, note that turning on tipping doesn’t mean your customers have to tip you. It is their choice.

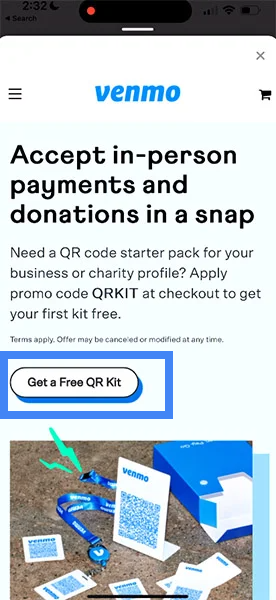

Step 4: Order a QR Kit (Optional)

To make in-person payments easier, Venmo provides a QR Kit. This is a physical QR code that customers can scan to pay you. Go to the “Business Tools” section in the app and order your free QR Kit. This is especially helpful for physical stores or events, where customers can quickly scan and pay without hassle.

Note that only the first QR kit is free as the kits cost $14.99 subsequently.

Step 5: Add a Card or Bank Account

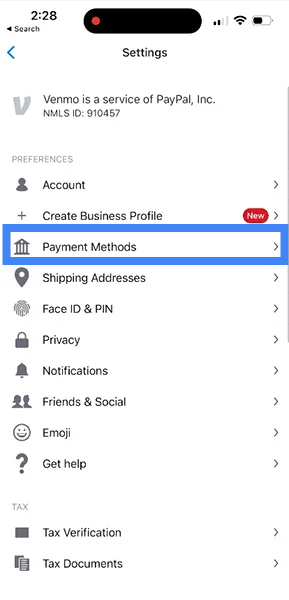

Lastly, you’ll need to link a bank account or card to your Venmo account to send money to other Venmo users or withdraw money. Tap “Payment Methods” in the settings, and choose to add a bank account or debit card. Venmo will guide you through the steps of entering and verifying your banking details. Once linked, you can transfer money from your Venmo account to your bank whenever you need to.

The table below gives an overview of the major Venmo for Business fees:

| Transaction Types | Fees |

| Transactions between Venmo Accounts | 1.9% + $0.10 |

| Credit card payments | 3% |

| Pay with Venmo | 3.49% + $0.49 |

| Instant transfers | 1.75% |

| International payments | 1.5% |

Once your Venmo business account is set up, receiving payments is easy. The funds go directly into your Venmo balance, which you can later transfer to your bank or card. Here are the ways you can accept payments:

Customers can pay you by searching for your business profile on the Venmo app. Once they find your profile, they simply tap “Pay,” enter the amount and confirm the transaction. It’s a simple and quick way to receive payments from Venmo users.

If you have an online store, you can add Venmo as a payment option. To do this, enable PayPal Checkout on your website. Once integrated, the Venmo button will appear on your checkout page, allowing customers to pay via Venmo. If they use a mobile device, the Venmo app will open for them to complete the payment. If they’re on a desktop, they’ll scan a QR code with their Venmo app.

For in-person payments, you can display a QR code in your store. Customers can scan the code using their Venmo app to send payments directly to their account. If you don’t have the QR code displayed, you can show the code from your phone for them to scan. This is great for quick, contactless payments.

Setting up Venmo for business comes with several advantages for businesses, both large and small. Here are some key benefits:

To set up a Venmo business account, follow the steps explained earlier in the article. Start by downloading the Venmo app and creating an account. Next, select the option to create a business profile and follow the prompts to enter your business details, including tax information. Finally, link a bank account or card to receive payments.

Setting up a Venmo business account is free, however, Venmo charges a processing fee of 1.9% + 10 cents for every transaction made to your business profile.

The main difference between Venmo and Venmo Business is their purpose. A personal Venmo account is for peer-to-peer payments between individuals, while a Venmo business account allows merchants to accept payments from customers.

No, Venmo doesn’t work internationally. Venmo is a US-based platform which means it is only restricted to people in the United States. This also means that Venmo does not work in Nigeria, but to own a virtual bank account that offers a free dollar card, visit Nosh.

To bypass this, some people try to use the VPN. If you get a VPN that can change your IP address to the US, you will have access to Venmo. However, you will still need a US number to register on Venmo.

A simple way to confirm if your Venmo account is a business account, is by checking your profile. Navigate to your menu and click the drop-down menu under your profile. If there’s an option to “Create a Business Account.” then your profile is personal and not business. You can do this on both app and website.

Setting up a Venmo business account is a simple way to start accepting payments from Venmo users. By following the easy steps in this guide, you can quickly get your business ready to receive payments. Venmo allows you to accept payments through your business profile, website, or in person via QR codes.

Additionally, Venmo’s lower fees, instant transfers, and social sharing features make it a great option for small businesses looking to grow. With Venmo, you can offer your customers a fast and convenient way to pay.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.