Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Picture this: You just finished dinner with friends, and one person picks up the bill. You pull out your phone to pay them back, but you’re staring at four app icons: Cash App, Venmo, Zelle, and PayPal. Which one should you tap? Each promises fast, easy money transfers, but they all work differently.

Whether you’re splitting a ride or paying your share of rent, choosing the right app matters. Some are great for personal payments, while others excel at business transactions or international transfers. The right choice can save you time, money, and headaches.

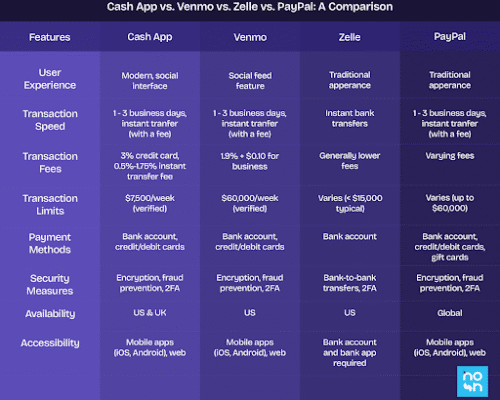

As someone who regularly uses these apps, I know how confusing it can be to pick one. That’s why I’ve broken down each platform based on their features, real use cases, and limitations. This guide is here to help you make the smartest choice for your situation. Here’s a comparison between all four platforms at a glance:

Cash App, Venmo, Zelle, and PayPal are all widely used digital payment services that have changed the way we handle money. Each platform has its own unique features, benefits, and drawbacks, making it important to understand what sets them apart.

Let’s take a closer look at what each platform offers, so you can decide which one is right for you.

Launched: 2013 by Square, Inc.,

Cash App is a mobile payment service platform that allows users to send and receive money, make online purchases, as well as invest in stocks and Bitcoin. It is popular for its user-friendly interface and integration with other financial services like Square and Cash Card.

Here’s a real world use case. Say you’re at a music festival and your friend pays for food and drinks using their card. You pull out your phone and instantly send them your share using their $Cashtag. Later, you decide to invest $20 in Bitcoin using the same app.

How Cash App Works

To use Cash App, simply:

Once linked, you can send and receive money from other Cash App users using their phone number or $Cashtag, which is their unique username). Additionally, you can buy shares of stocks and Bitcoin within the app.

Features

Pros

Cons

Account Limits and Verification

Verified users can send up to $7,500 per week. To unlock higher limits, Cash App requires users to verify their identity by providing their:

Launched: 2009

Venmo is a mobile payment service owned by PayPal. It is known for its social features and ease of use, making it popular for splitting bills and sending money to friends and family.

How Venmo Works

Similar to Cash App, you:

You can then send and receive money from other Venmo users using their phone number or username.

Features

Pros

Cons

Account Limits and Verification

Once verified, Venmo users can send up to $60,000 per week. Verification requires a full name, date of birth, SSN, and a photo ID.

Zelle is a peer-to-peer (P2P) payment service available through many major banks in the US. Unlike Cash App, Venmo, and PayPal, Zelle doesn’t operate as a separate app or platform. Instead, it is integrated directly within the mobile banking apps of participating banks.

For instance, you need to pay your landlord, and they prefer a direct bank transfer. Instead of writing a check or using a third-party app, you can simply open your banking app, use Zelle, and the money is deposited in their account in minutes.

How Zelle Works

To use Zelle, you’ll need to:

Once you have registered, you can typically find the Zelle option within the app and initiate transfers directly to the recipient’s bank account using their phone number or email address linked to their Zelle account.

Features

Pros

Cons

Founded: 1998

PayPal is a widely recognized online payment platform used by millions of businesses and individuals worldwide. It allows users to send and receive money online, shop online at participating merchants, and pay for goods and services.

This app is perfect for freelancers working with clients in another country. You can get paid securely through PayPal, and use the funds whichever way you like.

How PayPal Works

To use PayPal, you’ll need to:

Once linked, you can send money to other PayPal users using their email address or username, and you can receive money too. Also, you can use PayPal to make online purchases at millions of merchants worldwide or pay for services like subscriptions and invoices.

Features

Pros

Cons

Account Limits and Verification

PayPal lets you send up to $60,000 in a single transaction depending on your account status. Higher limits require verifying your identity and linking a bank account or credit card.

Related Article: Top 5 Best International Money Transfer Apps – 2025

Understanding the differences between these apps across various features, like transaction speed, fees, payment methods, and security, will help you pick the platform that suits your lifestyle and needs best.

All four apps are designed with simplicity in mind, but they each offer different vibes and navigation:

Speed matters, especially when you’re in a rush or need to pay someone instantly.

Let’s break down fees with real-world use cases to show what you’ll actually pay:

| Platform | Standard Transfers | Instant Transfers | Credit Card Fees | Business Fees |

| Cash App | Free (1–3 days) | 0.5%–1.75% fee | 3% fee | 2.75% per transaction |

| Venmo | Free (1–3 days) | 1.75% fee (min $0.25, max $25) | 3% fee | 1.9% + $0.10 per transaction |

| Zelle | Always free | Instant (no fee) | Not supported | Bank-dependent |

| PayPal | Free (with balance/bank) | 1.75% fee (US only) | 2.9% + $0.30 | 2.9% + $0.30 domestic, 4.4% international |

From the table above, you can see that Zelle is best for free instant bank transfers, while Venmo and Cash App can cost extra if speed is a priority.

Each app supports slightly different ways to fund transactions:

Looking for an app that supports flexible funding sources? PayPal offers the most versatile payment options, especially for international purchases.

Wondering which is the safest money transfer app? Here’s how they stack up:

Zelle may be the safest for bank transfers due to its use of your bank’s built-in security, while PayPal offers the strongest consumer protection for online purchases.

Where and how you can use these apps matters:

For international payments without needing a bank account, PayPal is clearly the top choice.

Verification is key to unlocking higher sending and receiving limits. Here’s what you can expect:

| Platform | Verification Requirements | Maximum Transfer Limits |

| Cash App | Full name, DOB, SSN, valid ID | $7,500/week (verified) |

| Venmo | Full name, DOB, SSN, ID photo | $60,000/week (verified) |

| Zelle | No in-app verification; bank handles this | Up to $5,000/day depending on bank |

| PayPal | Confirmed email, linked card/bank, SSN for some accounts | Up to $60,000 per transaction |

For high-volume transfers, Venmo and PayPal are the most flexible, once verified.

It depends on your needs. Use Cash App or Venmo for quick personal payments. Choose Zelle for instant, free bank transfers. Go with PayPal for online shopping, global payments, or business transactions.

All four are secure, but Zelle offers bank-level protection, and PayPal is the best for dispute resolution. It’s hard to go wrong with either.

No. Cash App is only available in the US and UK. Zelle works only within the United States and requires a US bank account.

Partially. You can create a PayPal Nigeria account to send money or shop online, but you cannot receive payments with a personal account. However, a business PayPal account allows you to invoice clients and request payments.

No. You can link a debit card or credit card instead. But to transfer funds to your bank, you’ll need to connect a US-based account.

Yes, if you’re only sending money within the US. Zelle is faster, free, and integrated into most major banking apps. However, PayPal is better for global transfers and e-commerce.

Yes. Zelle is built exactly for that and is often the best choice for instant bank-to-bank transfers with no fees.

In summary, choosing the right digital payment platform comes down to what matters most to you. Personally, I find Cash App and Venmo great for sending money to friends due to their user-friendly interfaces and social features. However, for more serious transactions like bank-to-bank transfers, I prefer Zelle for its security and direct integration with major banks.

On the other hand, PayPal’s widespread acceptance makes it a reliable option for businesses, online shopping and transactions across borders. By comparing the features and limitations of each platform, you can make an informed decision that aligns with your financial goals and lifestyle.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.