Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Imagine wanting to pay for something online, but your regular debit card keeps getting declined because it doesn’t work for international transactions.

Think about that important software subscription you need for your work or the online course that could elevate your skills. All these seem unachievable because of payment barriers, but a virtual dollar card comes in handy amidst all these.

With a virtual dollar card, you can make payments in dollars, even from Nigeria, without the hassle. This way, you can easily pay for items from international stores and also pay for subscriptions. In this article, I’ll show you how to get a virtual dollar card in Nigeria, so you can shop or pay for services anywhere in the world.

A virtual dollar card is a prepaid digital card that allows you to make payments in U.S. dollars. It works like a regular debit card, but instead of having a physical copy, all transactions happen online. You can load the card with Nigerian Naira, which would be converted to USD, and use it for international payments.

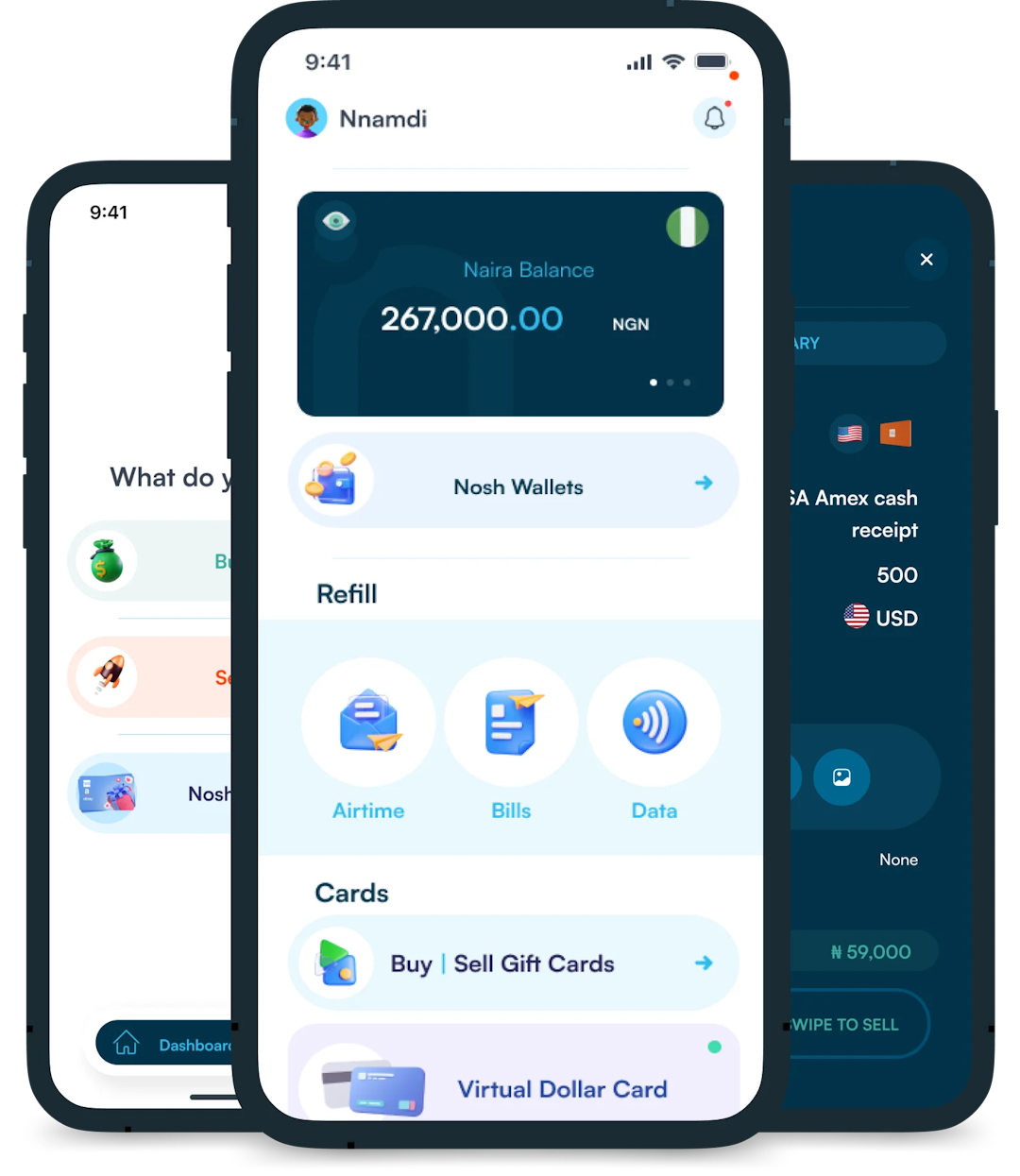

With a virtual dollar card, you get a card number, expiration date, and CVV, just like a physical card. However, it is safer because there’s no risk of losing it or having it stolen. Plus, you can easily manage and control your transactions through an app or online platform.

Some popular virtual dollar card providers in Nigeria include Barter by Flutterwave, Eversend, and Chipper Cash. These platforms offer easy access to virtual dollar cards, helping you make seamless international payments from the comfort of your home.

The exact procedure to obtain a virtual dollar card in Nigeria may differ based on the card provider you intend to use. However, they all still follow similar steps.

To get a virtual dollar card in Nigeria, irrespective of the platform you would use, here are the general steps involved:

Let’s examine these steps in detail.

The first step is choosing a provider that offers virtual dollar cards in Nigeria. There are several options like Grey, Bitnob, Eversend, Chipper, etc. When picking a provider, consider a few things:

Once you’ve weighed your options, choose the platform that best fits what you’re looking for.

After choosing a provider, download their app or visit their website to create an account. The sign-up process is usually quick and requires basic information like your name, email address, and phone number. Once your account is created, sign in to access the platform’s services.

Most virtual dollar card providers require you to verify your identity to comply with regulations. This is usually a simple process where you upload a valid form of ID, such as your national ID card, driver’s license, or international passport. Some platforms may also ask for a selfie for extra verification. This step ensures the safety of your account and protects it from fraud.

Once your account is verified, the next step is to choose the type of virtual dollar card you want and request it. You can decide to go for a Visa card or a Mastercard. Some platforms may offer options for personal, business, or even premium cards with additional benefits. For example, Eversend allows you to pick a card based on your needs, whether for small personal payments or higher limits for larger transactions.

When your virtual card is ready, you’ll need to add money to it before using it. Most platforms let you fund your virtual dollar card using your Nigerian bank account, a regular debit card, or even mobile money. Just transfer the amount you want, and it will automatically be converted to U.S. dollars and loaded onto your virtual card.

Once funded, you can use your virtual dollar card for online payments, shopping on international websites, subscribing to services like Netflix or Spotify, and more.

Living in Nigeria and trying to make international payments can be frustrating. A virtual dollar card solves these problems and offers you the freedom to make payments across the globe with ease. Here’s why you should get one:

Yes, you can use a virtual dollar card in Nigeria. Even though the card is funded in U.S. dollars, it works just like any other debit or credit card. You can use it to make online payments or pay for subscriptions without needing a physical card. It’s especially useful for Nigerians who need to make global payments.

To get a U.S. virtual card in Nigeria, you need to sign up with a virtual dollar card provider such as Barter by Flutterwave, Eversend, or Chipper. After creating an account, verify your identity by uploading your ID, and then you can request a virtual dollar card. Once the card is created, fund it from your Naira account, and it will convert the money to U.S. dollars.

You can use apps like Chipper Cash, Changera, Fundall, Bitnob, Barter by Flutterwave or Eversend to get a virtual dollar card in Nigeria. These apps are easy to use, and they allow you to fund your virtual card with Naira, which is then converted to U.S. dollars. Each platform offers a smooth, user-friendly experience to help you make global payments.

Getting a virtual dollar card in Nigeria is a simple and convenient way to make international payments without the hassles that come with traditional banking methods.

By following the steps outlined in this article, you can easily create an account, verify your identity, and fund your card to start making seamless payments across the globe. Plus, with providers like Changera, Eversend, and Chipper Cash, you have a variety of reliable options to choose from.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.