Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Wondering how to use Apple Pay in Nigeria? Apple Pay is one of the most secure ways to make payments for goods and services with just a tap. However, due to regional restrictions, Nigerian users often find themselves unable to add their bank cards to Apple Wallet.

The good news is that with the right approach, you can still take advantage of Apple Pay and enjoy this method of contactless payment in Nigeria. In this guide, I’ll walk you through the steps to set up and use Apple Pay in Nigeria.

Apple Pay is a mobile payment and digital wallet service provided by Apple Inc. It allows users to make fast contactless payments using an iPad, iPhone, or Apple Watch. This service offers a seamless, secure payment experience regardless of whether you’re using it in-store or online.

With Apple Pay, users can add credit, debit, or prepaid cards, or other payment methods to their Apple Wallet. It also allows users to redeem and use Apple gift card balances directly on the Wallet app. Once the balance has been added to Apple Wallet, users can use it to pay for products, services or subscriptions.

Apple Pay is accepted by many businesses, websites, and banks around the world, including in Nigeria. Most often, it is available as a contactless payment method at checkout on websites.

You can easily use Apple Pay to shop online through Safari, the App Store, and other apps that support it. Here’s how:

Using Apple Pay in-store is just as simple. Follow these steps:

You can also use Apple Pay to receive money, this service is called Apple Cash. It makes it easy to accept payments from friends, family, or customers directly to your device.

Aside from making payments, you can also use Apple Pay to receive money. This service, called Apple Cash, makes it easy to accept payments from friends, family, or customers directly to your device.

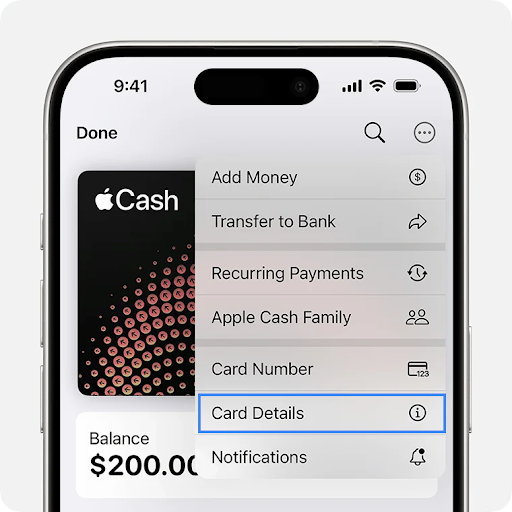

To start receiving money with your Apple Wallet, follow these steps:

Using Apple Pay for mobile payments in Nigeria comes with advantages like convenience, speed and security. Let’s take a look at these benefits.

1. Speed and Convenience

Most Nigerians today make payments with cards or mobile transfer. However, with Apple Pay in the mix, you don’t need cash or a card. You can make or receive payments quickly with just a tap of your device.

2. High-Level Security

With Face ID, Touch ID, and device-specific encryption, Apple Pay keeps your financial information secure and prevents unauthorized transactions.

3. No Extra Fees

Using Apple Pay in Nigeria does not come with additional charges. This allows you to make payments without worrying about extra costs.

4. Works Across Multiple Devices

Once set up, you can use Apple Pay on your iPhone, Apple Watch, iPad, and Mac. This gives you more flexibility in your transactions.

Before you can start using Apple Pay in Nigeria, you need to meet the following requirements:

Step 1: Check if Your Bank Supports Apple Pay

Before setting up Apple Pay, make sure your bank or card issuer in Nigeria supports it. You can check Apple’s official website or contact your bank for confirmation.

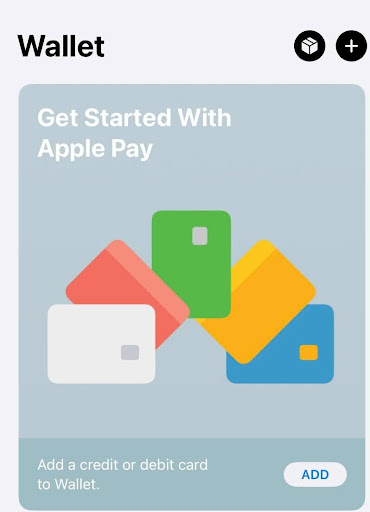

Step 2: Open the Wallet App

Step 3: Tap the “+” Button

In the Wallet app, tap the plus (+) button at the top-right corner of the screen to start adding your card.

You can enter your card details manually or use your iPhone’s camera to scan the card. Follow the on-screen instructions to input your card information.

Step 5: Verify Your Card

Your bank may require you to verify your card through a text message, email, or bank app. Complete the verification process as instructed.

Step 6: Set Up Apple Pay on Other Devices

Once your card is added, you can also set up Apple Pay on your Apple Watch, iPad, or Mac by following similar steps in the Wallet & Apple Pay settings.

Step 7: Start Using Apple Pay

After setting up Apple Pay, you can use it for contactless payments in stores, online shopping, and within apps. Simply double-click the side button on your device and authenticate with Face ID or Touch ID to make a payment.

You can also add more than one card to your Wallet and select which one to use during transactions.

Some Apple Pay alternatives in Nigeria include:

1. Wise

Formerly TransferWise, Wise is a platform that offers virtual debit cards that can be used for online transactions around the world. Here’s what you can expect when using a Wise virtual card:

2. PayPal

PayPal is another widely used digital payment service that allows users to send and receive money and make online purchases. Although it’s not directly linked to Apple Pay, you can use it as an alternative mobile payment in Nigeria method:

1. Is Apple Pay Free in Nigeria?

Yes, Apple Pay is free to use in Nigeria. There are no extra fees for making payments or receiving money using the service. However, your bank may charge standard transaction fees depending on the type of card or payment method linked to your Apple Pay account.

2. Can I Use Apple Pay With Any Bank in Nigeria?

No, not all banks in Nigeria support Apple Pay. You need to check with your bank to confirm if they allow Apple Pay transactions. If your bank doesn’t support Apple Pay, you can consider adding a virtual card to your Apple wallet.

3. How Do I Add Money to Apple Pay in Nigeria?

You can’t directly add money to Apple Pay in Nigeria. Instead, you link your debit, credit, or prepaid card to your Apple Wallet. Apple Pay then uses the funds from these cards for transactions.

4. Can I use Apple Pay for International Transactions?

Yes, you can use Apple Pay for international transactions. As long as the merchant accepts Apple Pay and your linked card allows international payments, you can use it to shop or send money abroad.

5. How Can I Withdraw Money From Apple Pay?

To withdraw money from Apple Pay, you need to transfer it to your linked bank account. Open the Wallet app, select Apple Card, tap “Withdraw“, and follow the instructions to transfer the funds to your account.

Apple Pay is a secure and convenient payment option that is gaining traction in Nigeria. While not yet as widely used as some other methods, it offers significant advantages for both local and cross-border transactions, especially with support from fintech platforms like Flutterwave and Paystack.

Setting up Apple Pay is simple, and once done, you can use it for online and in-store payments or receive money through Apple Cash. With its ease of use, fast transactions, and strong security features, Apple Pay is a valuable tool for anyone looking to simplify their payment experience in Nigeria. Follow our simple guide to set it up.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.