Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Times are tough, and for many Nigerians, Loan apps are now part of everyday survival. According to recent data, 27% of Nigerians across various income levels now rely on loan apps to manage their daily expenses.

These apps allow people to borrow money quickly without visiting a bank or filling out long forms. Loan apps offer instant access to credit without paperwork, long queues, or the collateral that traditional banks require.

After testing and comparing several loan apps firsthand, I’ve put together a list of the top 7 that actually deliver on their promises. In this article, I’ll walk you through how each app works and which ones stood out in terms of speed, interest rates, and reliability.

Mobile loan apps have transformed the way people access credit in Nigeria. In no particular order, after careful research, here are the top seven loan apps in Nigeria as of 2025 that I recommend:

Let’s take a detailed look at them and what they offer.

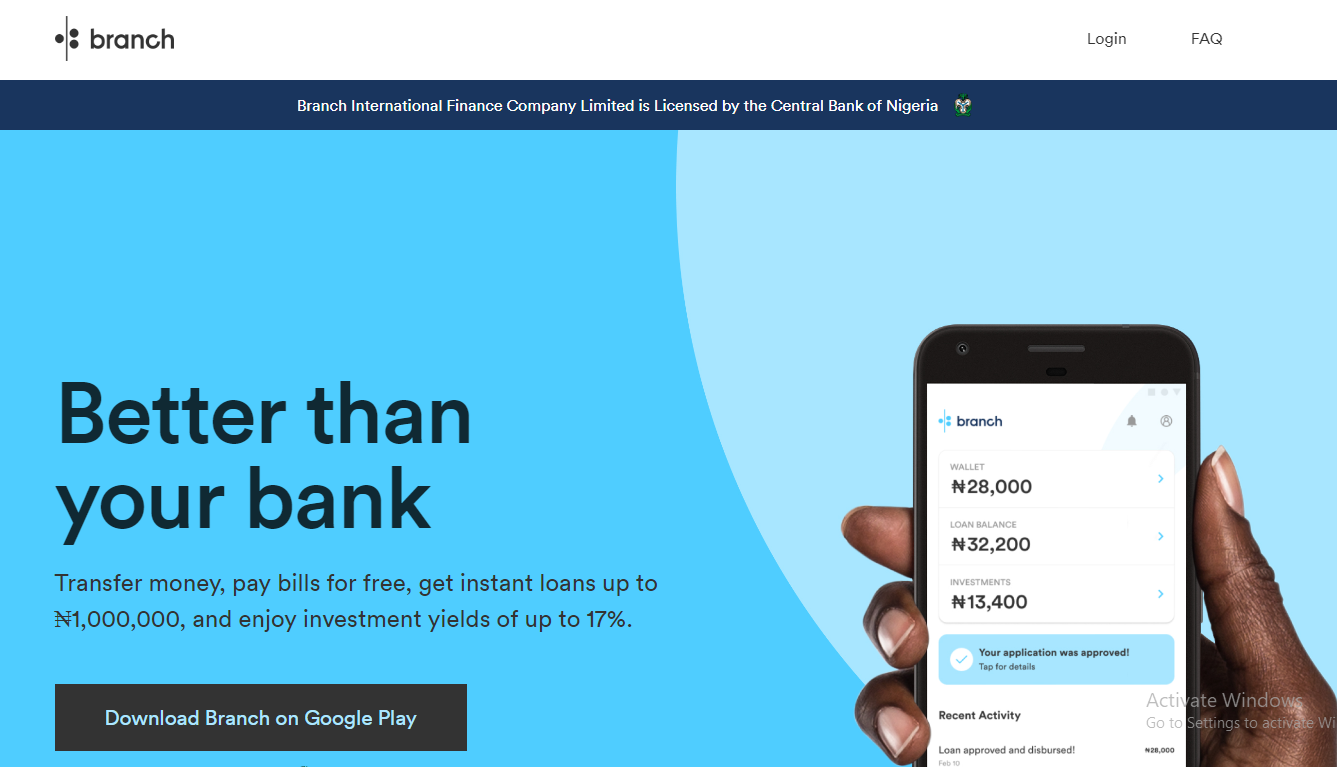

Branch is a leading loan app in Nigeria known for its efficiency and ease of use. This app was launched in 2015, and it provides instant personal loans with minimal paperwork. It uses technology to evaluate your creditworthiness and offer loans based on your financial behaviour.

The app is simple to use, and once you apply, your loan is processed in minutes. Branch is available on both Android and iOS platforms, making it accessible to a wide range of users.

Pros

Cons

Formerly known as Paylater, Carbon provides personal and business loans with an emphasis on fast approval and easy management. It offers a range of financial services, including credit, investment, and bill payments.

The app has a smooth interface, making it easy to navigate and apply for loans. Carbon is available on both Android and iOS. It also provides notifications and reminders to help users stay on top of their loan commitments.

Pros

Cons

EaseMoni is one of the popular loan apps in Nigeria, designed to provide quick loans for personal emergencies and other needs. The app focuses on simplicity and speed.

The EaseMoni app is user-friendly, with a straightforward application process. You can apply for a loan in just a few steps, and the app provides instant feedback on your loan request. However, the app is available for download only on Android devices.

Pros

Cons

FairMoney is an established loan app that offers quick personal and business loans without requiring collateral. It is known for its fast loan approval process and flexible repayment options.

FairMoney’s app is designed to be simple and efficient. Users can apply for loans, check their loan status, and manage their repayments with ease. The app also offers savings features and provides good customer support to assist with any issues. It is available on both Android and iOS platforms.

Pros

Cons

RenMoney is one of the top loan providers in Nigeria, offering both personal and business loans. It provides a range of financial products and is known for its customer-friendly approach.

The RenMoney app is designed for ease of use, with a simple application process and quick loan approvals. The app also offers tools to help users manage their loans effectively. You can download the app on both Android and iOS devices, making it accessible to a wide user base.

Pros

Cons

OKash offers quick personal loans designed to address urgent financial needs. The app focuses on providing fast, short-term loans with minimal documentation.

The OKash app is straightforward, making it easy to apply for and manage loans. Users can get instant feedback on their loan requests and track their repayment schedules. It is available for download on Android devices.

Pros

Cons

Palmcredit is a loan app in Nigeria that offers easy access to funds for various needs, including personal emergencies and business expenses. It is known for its quick approval process and user-friendly interface.

The Palmcredit app provides a simple and efficient loan application process. Users can easily apply for loans, check their status, and manage their repayments. It is available for download only on Android devices.

Pros

Cons

Before picking one of the loan apps in Nigeria to use, it’s important to make sure it fits your needs and financial situation. While some apps are ideal for short-term, quick repayments, others offer longer tenures that may come with higher interest rates.

First, think about why you need the loan. Are you borrowing money for an emergency, a big purchase, or to start a business? Considering the purpose will help you choose the right app and loan type. Some apps are better for quick personal loans, while others suit longer-term financial needs.

For example, FairMoney allows top-up loans and lets you spread repayment across two to four months, suitable for managing medium-sized expenses over time. In contrast, Branch starts with smaller amounts but can be ideal for building credit gradually due to its lower interest rates.

Interest rates are the cost of borrowing money. Different apps offer different rates, so it’s important to compare them. Lower interest means less to repay over time. Branch is one of the better options in terms of interest rate, but users may start with lower loan limits.

FairMoney, on the other hand, offers larger amounts but charges higher interest especially for longer tenures. Always check the total repayment before accepting a loan offer.

Repayment terms refer to how long you have to repay the loan and how frequently you’re expected to make payments. Some apps offer short-term loans, while others allow for extended repayment plans. FairMoney offers flexible repayment options ranging from two to four months, though at a higher cost.

EaseMoni and Palmcredit provide quick disbursement but often have shorter durations with high daily interest penalties for late repayment. Choose a repayment plan that fits your cash flow and financial comfort zone.

It’s wise to check customer reviews and ratings before choosing a loan app. Real user feedback can tell you a lot about loan approval speed, hidden charges, and customer support. Carbon is often praised for its easy-to-use interface and repayment flexibility.

However, OKash and EaseMoni have been consistently flagged for poor customer service and aggressive follow-ups. Look for apps with a strong track record of transparency and responsive support.

Yes, many loan apps in Nigeria offer instant loan approvals. Once you complete your registration and meet the eligibility criteria, funds can be disbursed within minutes to a few hours.

The processing time varies by app. Most apps offer same-day approval, and disbursement is usually within a few minutes to 24 hours after approval.

Most digital loan apps in Nigeria are unsecured, meaning no collateral is required. Top apps like Branch, Carbon, FairMoney, Palmcredit, and OKash offer loans based on your BVN, financial history, and phone data, not physical assets.

Monthly interest typically ranges from 10% to 30%, depending on the app, loan amount, repayment period, and your credit score. For example, Branch has relatively low interest but smaller initial loan limits, while FairMoney offers longer repayment but with high rates.

Apps like FairMoney and Renmoney offer longer tenures, ranging from 2 to 6 months or more.

Most loan apps registered under CBN-licensed microfinance banks are relatively safe. However, always read user reviews and confirm the app’s legitimacy before applying. Avoid apps known for unethical practices or unauthorized data access.

Yes, many reputable loan apps like Branch, FairMoney, and Carbon report to Nigerian credit bureaus. Late repayment can negatively affect your credit score, which can make it harder to access future loans from banks and fintech platforms.

It depends on the app. Some platforms like EaseMoni and FairMoney allow top-up loans or multiple loans based on your creditworthiness, while others only approve one active loan at a time.

Late repayment often leads to penalty fees, increased interest, and damage to your credit score. Some apps may also send persistent reminders via SMS or calls. In extreme cases, your BVN may be flagged with credit bureaus.

Loan apps are a convenient way to access quick loans in Nigeria, but many users report downsides like persistent calls, unsolicited loan ads, and auto-borrow pop-ups that can feel intrusive or even traumatic over time.

Before applying, consider the purpose of the loan to ensure the app meets your needs. Also, compare interest rates to find the most cost-effective option, and carefully read the repayment terms, as they may contain clauses that could lead to unexpected charges or stricter conditions if missed.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

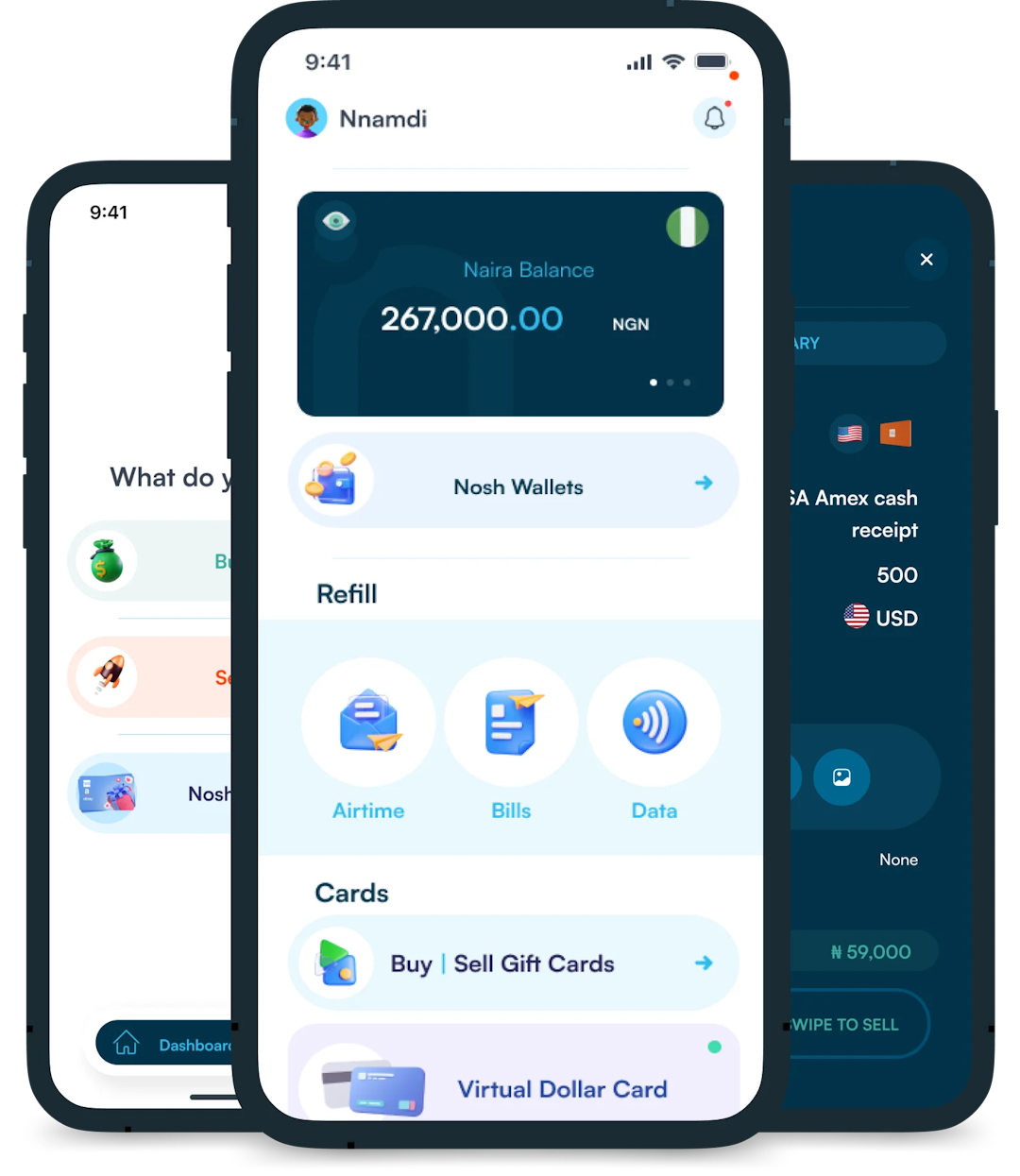

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.