Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

I have lost count of the number of times I have reached the checkout page of a website, only for my Nigerian Naira debit card to decline. Or should I talk about being unable to pay for subscriptions? The point here is that as a Nigerian living in Nigeria, it is quite difficult to make international payments. I’m sure you can relate too.

To address this issue, some fintech companies offer virtual dollar card services. Now, there are various virtual dollar card providers you can choose from to make your international payments seamless. With these virtual cards, you can easily and securely pay for things online.

In this article, I am going to talk about the 5 top virtual dollar card providers in Nigeria. After that, we will consider the factors that one needs to take into account when selecting a virtual USD card provider. But first, let’s begin with understanding exactly what a virtual dollar card is.

A virtual dollar card is a digital dollar-denominated card that works like a regular credit or debit card. You can use it to make purchases and payments online in US dollars, without needing a physical card. This makes it perfect for shopping on international websites, paying for subscriptions, and even booking flights.

With a virtual dollar card, you get a card number, expiration date, and CVV, just like a physical card. However, it is safer because there’s no risk of losing it or having it stolen. Plus, you can easily manage and control your transactions through an app or online platform.

Many Nigerians are turning to virtual dollar cards because they offer convenience, security, and easy access to global markets. Now, let’s get into the top 5 virtual dollar card providers in Nigeria!

As I mentioned earlier, there are many virtual dollar card providers in Nigeria. With a virtual dollar card from these providers, you will be able to make payments across borders. If you want, you can even choose to have multiple virtual dollar cards from different providers.

Below are the top 5 virtual USD card providers in Nigeria I recommend:

Now, let’s talk about each one of them.

Chipper Cash offers a seamless way to get a virtual dollar card. You can quickly sign up and start using your card for online purchases. Chipper offers a virtual Visa card that can be reloaded or topped up with funds from your Chipper wallet. You can also send money internationally, making it a versatile choice for many Nigerians.

The app allows you to track your spending easily, and the virtual card works smoothly with most online platforms. Chipper Cash is a popular option that you can trust as it has over 5 million registered users. Aside from Nigeria, Chipper Cash also works in Ghana, South Africa, Kenya, Uganda, Rwanda, the US and the U.K.

With over 750,000 users, Eversend is another great option for a virtual dollar card in Nigeria. It provides a secure and easy way to manage your finances. You can use your Eversend card for shopping online, paying for subscriptions, and more.

The app is easy to use, and the customer service is highly responsive. Additionally, Eversend offers features like multi-currency wallets, allowing you to hold and exchange different currencies, which is handy for frequent travellers. The app also works in other African countries like South Africa, Kenya, Ghana, Rwanda, and Uganda.

Fundall is a trusted virtual dollar card provider in Nigeria. It offers a convenient way to make international payments and manage your finances digitally. With Fundall, you can easily create a virtual dollar card and use it to make international payments.

The app allows you to track your spending, manage your budget, and make secure transactions. Fundall provides competitive fees and transparent pricing, ensuring you know what you’re paying for each transaction. Their customer service is responsive and ready to assist you with any issues or questions you may have.

Bitnob is another reliable virtual dollar card provider in Nigeria. It offers a unique take on virtual dollar cards by integrating cryptocurrency. If you’re into crypto, Bitnob lets you convert your assets into USD and use them through a virtual card.

However, you can also just use Bitnob to create a virtual dollar card without using its crypto features. With this virtual card, you can pay for local and international online purchases and subscriptions. Additionally, Bitnob provides options for saving and earning interest on your crypto holdings, making it a multi-functional financial tool.

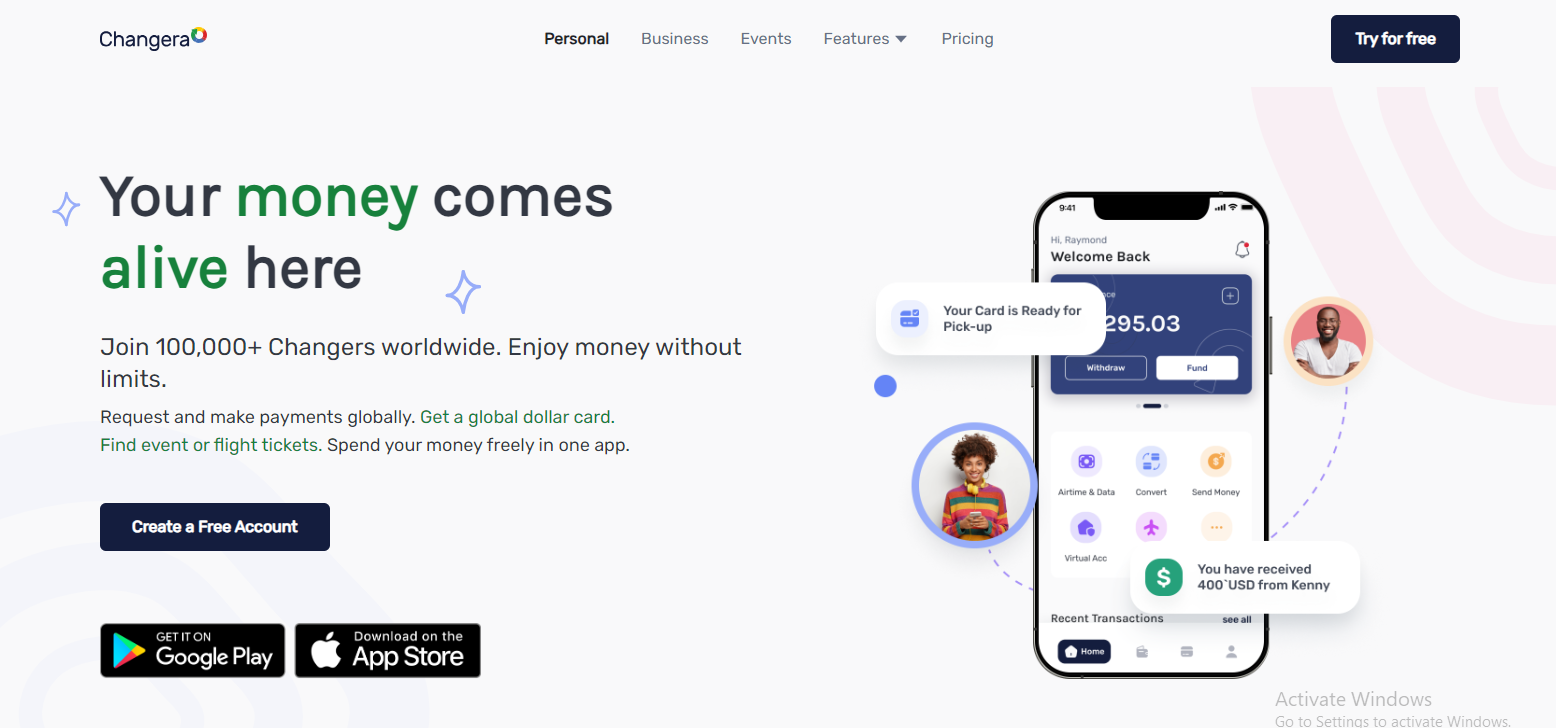

The last virtual dollar card provider we’ll be looking at is Changera. Changera’s platform is easy to use, and you can get your card set up in no time. It makes international shopping and payments a breeze. With Changera, you also benefit from low fees and fast transactions.

The app includes features like bill payments and airtime top-ups, adding extra convenience for everyday use. The platform is highly secure as it uses strong encryption protocols and fraud protection measures to ensure safe transactions.

These providers make accessing virtual dollar cards simple, which in turn makes cross-border payments seamless. Aside from using virtual USD cards, you can also use gift cards for international payments and subscriptions.

Now, let’s take a look at the features you should consider when trying to pick a virtual dollar card provider to use.

1. Security

Security is very important. Make sure the provider uses strong encryption and other security measures to protect your money and personal information. Look for features like two-factor authentication and instant notifications for transactions. A secure card gives you peace of mind when making purchases online.

2. Card fees and limits

Pay attention to the fees and limits associated with the card. Some providers charge monthly maintenance fees, transaction fees, or foreign exchange fees. Check if there are limits on how much you can spend or withdraw. Choose a provider with reasonable fees and limits that match your spending habits.

3. User-friendliness

A user-friendly app or website makes managing your virtual dollar card easy. Look for a provider with a simple and intuitive interface. You should be able to view your balance, track spending, and manage your card settings without any hassle. A smooth user experience saves you time and frustration.

4. Customer service

Good customer service is essential, you don’t want to be stuck when you need help. If you run into issues or have questions, you want prompt and helpful support. Check if the provider offers multiple ways to contact customer service, such as chat, email, or phone. You can also read reviews to have an idea of the quality of their support.

1. What is the best virtual dollar card provider in Nigeria?

The best virtual dollar card provider in Nigeria depends on your needs. Due to this, one cannot specifically name a particular provider as the best. Your best bet is to do your own research to figure out which provider will work best for you. Each provider has its strengths, so choose one that fits your requirements best.

2. How can I get a virtual dollar card in Nigeria?

Getting a virtual dollar card in Nigeria is simple. First, choose a provider, download their app, sign up, and verify your identity by providing the required documents.

Once your account is set up, fund it through your bank or any other payment method. After funding your account, you can easily create your virtual dollar card within the app and start using it for online purchases and international transactions.

3. Which Nigerian bank has a virtual dollar card?

Few Nigerian banks offer virtual dollar card services such as Alat by Wema and Kuda Bank. Alat by Wema provides a digital platform where you can easily create and manage your virtual dollar card. Kuda Bank also offers a virtual dollar card that is easy to set up and use for international payments and online shopping.

Making international payments as a Nigerian can be challenging, but virtual dollar cards offer a simple solution. These cards make it easy to shop online, pay for subscriptions, and handle other transactions in US dollars. The recommended providers in this article are Chipper Cash, Eversend, Fundall, Bitnob, and Changera.

When choosing a virtual dollar card provider, consider factors like security, fees, user-friendliness, and customer service. By picking the right provider, you can enjoy seamless and secure international payments.

Also, you can use gift cards to make international purchases and pay for subscriptions easily. If you’re looking for where to buy gift cards with Naira, look no further than Nosh.

Virtual dollar cards have become increasingly popular in Nigeria, offering a convenient and secure way to make online payments in USD. These digital cards provide a solution to the limitations...

Have you ever looked at your bank account and wondered, “Is there a smarter way to grow my money than just saving it?” If yes, you're not alone. I’ve been...

As an Education graduate in Nigeria, the most accessible job offer for me is teaching in privately owned schools. The implication of this is working hard to earn a penny...

The Naira is weakening, which means your savings and investments are under threat. How do we know this? Well, the Nigeria Bureau of Statistics puts the current inflation rate at...

The Bank Verification Number (BVN) is a unique 11-digit number issued by the Central Bank of Nigeria (CBN) to every individual with a Nigerian bank account. It helps protect customers...

Have you ever found yourself Googling things like 'cheapest way to send money to Nigeria' because you’ve had a terrible experience with high fees, slow transfers, or confusing apps? I’ve...

Get the APP today to start enjoying amazing deals with #TopNOSHExperience.